ACI research: digital payments are the most popular in India

The Paypers

DECEMBER 6, 2021

Latest research from ACI and YouGov has showed that digital payments are the most used payment method for festive season spending.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

digital-payments-research

digital-payments-research

The Paypers

DECEMBER 6, 2021

Latest research from ACI and YouGov has showed that digital payments are the most used payment method for festive season spending.

PYMNTS

JANUARY 1, 2021

PYMNTS has tracked those changes every step of the way via exclusive research , Tracker reports and studies, starting on March 6, a full 10 days before the country – or large swaths of it – were locked down. Office shifters plan to use digital shopping options more than other consumers after the pandemic has passed,” the report noted.

PYMNTS

JANUARY 28, 2021

One of the more notable differences is their tendency to favor credit cards online and other options such as digital wallets over debit cards. PYMNTS’ latest research report, Online Security And The Debit-Credit Divide , a PYMNTS collaboration with Elan based on a survey of 2,466 U.S. The report finds that 45 percent of U.S.

PYMNTS

JANUARY 18, 2021

A big part of the agenda is about the shift to digital in a world where, according to PYMNTS research, more than 124 million Americans have already made the digital shift for shopping for retail products, groceries and food from restaurants since March of 2020.

CB Insights

AUGUST 9, 2021

The site, which bills itself as a “100% digital bank,” also allows users to buy now and pay later on Unified Payments Interface (UPI), a real-time payment system regulated by the Reserve Bank of India. The post This Nubank–Backed Indian Neobank Raised $71M To Hire Talent appeared first on CB Insights Research.

PYMNTS

JANUARY 26, 2021

The coffee giant has built a loyal customer base over the course of 13 years, leveraging data it gathers from its customers’ ordering and payments preferences. . Recent research highlighted in the December issue of the Delivering On Restaurant Rewards report, which is based on a survey of 2,123 U.S. consumers, helps explain why.

CB Insights

SEPTEMBER 7, 2021

download our best of blockchain research. Custody, wallet, & digital asset services: These companies provide crypto asset storage, security, management, and investment products for institutions and consumers. Genesis Digital Assets , a US-based bitcoin miner, raised $125M in funding in July 2021. First name. Company name.

CB Insights

JANUARY 5, 2021

In the past few years, the burgeoning popularity of digital banks has only underscored the severity of these problems, with upstarts like Chime and SoFi offering cheaper, faster, and more convenient banking experiences. . Below, we dive into how the Covid-19 pandemic has accelerated the shift to digital banking among these populations.

CB Insights

JUNE 3, 2021

Kushki , a payment platform, has raised $86M in a Series B with participation from SoftBank Group, Kaszek Ventures, and Magma Partners, among others. The post SoftBank Group-Backed Kushki Raises $86M To Scale Its Payments Infrastructure Platform appeared first on CB Insights Research. How’s the company performing?

PYMNTS

JANUARY 21, 2021

In the bid to hasten their digital transformation, when it comes to innovation , financial institutions (FIs) may benefit from an “app store” approach as they weigh existing and new solutions. PYMNTS’ own research has found that consumers are more willing than ever to switch banks in pursuit of better apps and user experiences.

PYMNTS

JANUARY 27, 2021

Favorite restaurant status in 2021 is expressed digitally. Customers will convey most-favored eatery status digitally if (but only if) you meet their ever-rising expectations. AI To IA’ As New Digital Dinner Bell. Declines that are becoming more and more reversible, as digital tech is brought to bear.

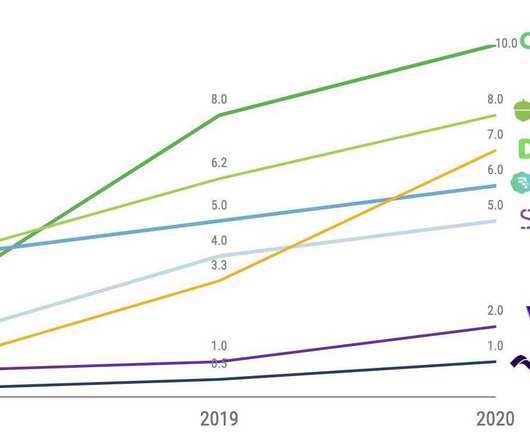

CB Insights

JUNE 21, 2021

Startups and new players across financial services are seeing growth in users and revenue as more consumers increasingly embrace digital. Incumbents are also launching new digital businesses and seeking out partners and vendors to ensure they have the tech capabilities necessary to excel now and in the future. . Real-time payments.

CB Insights

OCTOBER 26, 2021

Which sector, from payments to digital lending to capital markets tech, saw a blockbuster $2B quarter. The post State Of Fintech Q3’21 Report appeared first on CB Insights Research. Top equity deals of the quarter, including 3 of the top 5 raised outside the US.

CB Insights

AUGUST 26, 2021

Paysafe , a specialized payment solutions company, acquired SafetyPay , a digital payments platform, for $441M in an all-cash deal. The platform offers online cash transactions, global multicurrency settlements, and cross-border payments. The deal is expected to close in Q4’21. WHO ARE THE PARTIES TO THE DEAL?

CB Insights

JULY 7, 2021

India-based Pine Labs is a cloud-hosted digital payment gateway that facilitates contactless payment for retailers and merchants in India and Southeast Asia. The company has reportedly processed an annualized gross transaction value (GTV) of $1B and payment gateway transactions worth $20.1M (INR 150 crore).

PYMNTS

JANUARY 1, 2021

This year, the PYMNTS data and analytics team published 252 reports that tracked the data, innovations and disruptive thinking that are reshaping the payments and commerce business. Digital-First Banking. CFOs Guide To Digitizing B2B Payments. We suspect this is going to broaden the demographic.”.

CB Insights

JULY 26, 2021

Visa, a digital payment network, has acquired Currencycloud , a cloud-based solution for cross-border payments. Visa: California-based Visa is a global payments technology firm that enables digital currency transactions across 200 countries for governments, businesses, and banks. WHO ARE THE PARTIES TO THE DEAL?

CB Insights

JUNE 17, 2021

From digital banking and lending to budgeting and payments, tech giants are revamping their financial services offerings through partnerships with legacy institutions and in-house solutions that fit into their wider product ecosystems. . How big tech’s product strategies differ across banking, payments, lending, and e-commerce.

PYMNTS

FEBRUARY 1, 2021

In today’s top retail news, Amazon Go stores in Seattle are reportedly being equipped with Amazon One palm-reading scanners, while automotive brands are taking control of digital purchasing platforms. The tech lets shoppers use their palms as an ID and payment method. A year ago, PYMNTS research indicates, Amazon claimed 9.5

CB Insights

JUNE 11, 2021

Indonesia-based BukuWarung is a micro, small, and medium enterprise ( MSME)-focused accounting and digital payment application that offers financial products for lending, insurance, savings, and cash and credit transactions. in annualized payments to date and plans to process payments worth over $10B by 2022.

CB Insights

AUGUST 19, 2021

Branch , a worker payment software provider, has raised $48M in a Series B funding round — with participation from Drive Capital, CrossCut Ventures, and Bonfire Ventures, among others — and $500M in a line of credit from Neuberger Berman. HOW’S THE COMPANY PERFORMING? Become a CB Insights customer.

CB Insights

APRIL 21, 2021

Global payments giant Mastercard has acquired Ekata , a digital identity and security platform provider, in a $850M deal. Its products help clients authenticate identities in real-time in account opening, payments, or various other digital processes. Who are the parties to the deal? Become a CB Insights customer.

CB Insights

AUGUST 16, 2021

Bento for Business: California-based Bento for Business is a digital spend management platform for SMEs that helps businesses keep track of expenses through a pre-loaded card. US Bancorp: Minnesota-based US Bancorp provides global consumer and business banking, insurance, payment, and mortgage services. Become a CB Insights customer.

CB Insights

JUNE 1, 2021

SpotOn , a digital payment company, has raised $125M in a Series D with participation from Andreessen Horowitz, DST Global, and 01 Advisors, among others. The post Andreessen Horowitz-Backed SpotOn Raises $125M, Hitting Unicorn Status appeared first on CB Insights Research. HOW’S THE COMPANY PERFORMING?

PYMNTS

JANUARY 19, 2021

New research of roughly 2,000 of U.S. Venmo customers as of October 2020 offers a clearer snapshot of these customers' new financial habits and purchase and shopping behaviors, and how they view Venmo as a payment method. Generation Venmo is also the prototypical digital-shifter.

CB Insights

SEPTEMBER 24, 2021

San Francisco-based PandaDoc’s digital transactions management solution helps users generate e-signatures and collect payments for contracts, quotes, forms, and invoices. The post E-Signature Provider PandaDoc Joins Unicorn Club After Closing Series C Round appeared first on CB Insights Research.

PYMNTS

JANUARY 28, 2021

Adventuring to different markets worldwide, PYMNTS continues to document how the digital shift that caught fire in 2020 continues shaping spend trends and consumer sentiments. The January 2021 Global Digital Shopping Index: United Kingdom Edition is based on a survey of more than 2,000 consumers and 560 merchants in the U.K.

PYMNTS

JANUARY 13, 2021

Still others rolled up their sleeves, pivoted their business models and embraced the digital-first economy. The good thing is, despite all of those negatively impacted to the point of failure, the businesses that have embraced digitization and new technology are actually more optimistic because they believe their client base has expanded.

CB Insights

AUGUST 27, 2021

Cora , a digital lending platform, has raised $116M in a Series B. Brazil-based Cora develops digital finance tools for small and medium businesses. The company offers digital accounts and payment wallets to roughly 140,000 small and medium enterprises. How’s the company performing? Want the full post?

CB Insights

OCTOBER 20, 2021

The digital asset management platform completed the transaction and went public in October 2021. In March 2021, PayPal acquired Curv for $200M, integrating the digital asset security company into its recently launched, blockchain-focused business unit. appeared first on CB Insights Research. EXITS: 1 IPO, 1 SPAC, 4 M&A.

PYMNTS

JANUARY 14, 2021

A year ago, solidifying a digital business was still at the level of a “nice to do” for most SMBs. A year and one global pandemic later, digital transformation has become a need-to-do for SMBs looking to survive the storm. Embracing Optimism With an Array of Digital Tools. Embracing the Fast-Paying Marketplace .

The Paypers

SEPTEMBER 3, 2021

PhonePe has launched a digital payments market insight platform called Pulse, which will provide researchers, business developers, regulators and journalists access to pin-code-level transaction data across India.

CB Insights

FEBRUARY 16, 2021

Among plenty of emerging use cases, the technology aims to create a new and improved payments system for the world — one that’s secure, transparent, decentralized, fast, and uses cryptocurrencies (types of digital cash) as a means of exchange. without the extreme volatility that comes with most other types of digital coins.

PYMNTS

JANUARY 8, 2021

The restaurant industry was quick to adopt the digital tools needed to stay in business as consumers moved away from in-restaurant dining to dining at home at the beginning of the pandemic. Digital purchasing options have not eliminated their financial wo rries, however.

PYMNTS

FEBRUARY 1, 2021

As PYMNTS' January 2021 Healthcare Payment Experience Report , done in collaboration with Rectangle Health , notes, “The stakes are extraordinarily high. The inaugural Healthcare Payment Experience Report is an immersion into developments that are rapidly reshaping payments for a healthcare system that is itself in recovery.

CB Insights

JUNE 30, 2021

PayMaya , a Philippines-based payments and financial services platform, has raised $121M with participation from Tencent Holdings, KKR, International Finance Corporation, among others. Its customers can pay, add, cash out, and remit money at any of its 250,000 digital touchpoints across the nation. HOW’S THE COMPANY PERFORMING?

PYMNTS

JANUARY 29, 2021

In this week's news, we saw Quevos secure funding, new data on loyalty and rewards programs, and research on how nonprofits are using digital payments. Open Banking Meets Instant Payments at the Online Checkout. Flexible Healthcare Payments Provide Critical Care to Patient Satisfaction. Trackers and Reports.

PYMNTS

JANUARY 8, 2021

Among other topics extensively reported, PYMNTS' latest Global B2B Payments Playbook , done in collaboration with Worldpay B2B Payments , zeroes in on international B2B payments friction, and how digital invoicing and payments are making it easier for B2B funds to cross borders. Automation addresses these issues.

PYMNTS

JANUARY 8, 2021

Research indicates that consumers are recovering some of their financial confidence, with one report predicting a 64 percent year-over-year increase in new credit card applications in 2021. It is therefore important for retailers to examine how they are offering such payments to maintain customers’ attention.

CB Insights

SEPTEMBER 16, 2021

It caters to 54 financial service companies, mainly in the digital payments sector, and has helped them onboard more than 5M customers across 197 countries. To Support Global Expansion appeared first on CB Insights Research. Operating in 211 jurisdictions, PassFort caters to a diverse customer base.

PYMNTS

JANUARY 27, 2021

But for consumers, as noted by PYMNTS research, more than half of subscribers rank saving money among the top three reasons for considering buying subscription bundles. As a result, he told PYMNTS, the incumbents need to step up their digital game and add new value to stay relevant and competitive. Embracing The Subscription .

The Paypers

DECEMBER 21, 2021

New research from technological research and consulting company Gartner has mentioned that 20% of big companies will use digital currencies as collateral or to make payments by 2024.

CB Insights

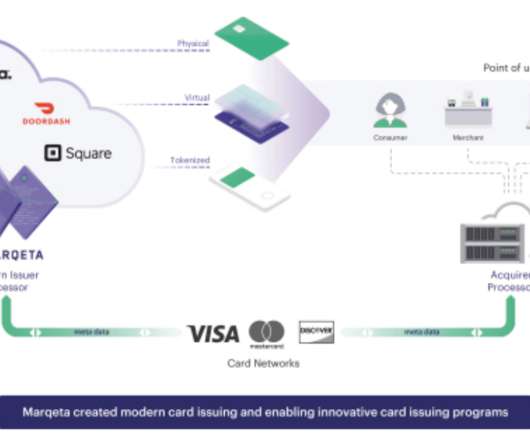

JUNE 7, 2021

Marqeta allows businesses to offer payment card products to customers without having to deal directly with a traditional bank. It handles the back-end payment technology while working with banks that process the payment transactions. . Tailwinds: Rapid acceleration of digital payments and a more modern payments ecosystem .

FICO

NOVEMBER 22, 2021

digital fraud was up 25% in the first four months of 2021 and continues to grow during the holiday season. These messages often include a "tracking link" that you are urged to click in order to update your delivery or payment preferences. in pet scams so far this year , so it’s important to do your research on sellers.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content