Durbin to reintroduce credit card competition bill

Payments Dive

FEBRUARY 25, 2025

The senate minority whip from Illinois plans to reintroduce the Credit Card Competition Act proposal in a bid to increase competition for Visa and Mastercard.

Payments Dive

FEBRUARY 25, 2025

The senate minority whip from Illinois plans to reintroduce the Credit Card Competition Act proposal in a bid to increase competition for Visa and Mastercard.

Fintech Finance

FEBRUARY 28, 2025

dtcpay , a leading stablecoin payments solution in Singapore, is thrilled to announce a groundbreaking partnership with Metro, one of Singapores most iconic and trusted department stores. This collaboration marks a bold step into the future of retail, empowering Metro customers to shop seamlessly using stablecoins. As the retail landscape continues to evolve, Metro is pioneering the integration of cutting-edge payment technology, ensuring it remains at the forefront of innovation.

Finextra

FEBRUARY 25, 2025

PayPal is bidding to boost its in-person payments presence through a global partnership with Verifone.

The Payments Association

FEBRUARY 27, 2025

Founded in 2016, Flutterwave has become a leader in African enterprise payments, processing over 890 million transactions valued at $34 billion to date. The companys 2024 report highlights the companys strides in broadening its global presence, advancing its technological capabilities, and delivering exceptional value to multinationals expanding into or across Africa.

Speaker: Benjamin Woll

Enterprise commerce is evolving fast, and brands relying on rigid, one-size-fits-all solutions risk losing agility. But modernization doesn’t have to mean disruption. In this webinar, we’ll explore how an extensible, modular approach empowers brands to integrate new capabilities, enhance performance, and scale efficiently—all while leveraging Shopify’s strengths.

Fintech Finance

FEBRUARY 24, 2025

Nexi, the European PayTech, serving millions of merchants in more than 25 countries, and Klarna, the AI-powered payments and commerce network, have expanded their relationship into a global partnership. Nexi will enable its merchant customers across Europe to seamlessly offer Klarna’s payment method to their shoppers. Klarna will be automatically enabled as a default option in the Nexi check-out offering, allowing merchants to drive incremental revenue growth thanks to the added-value and

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Payments Dive

FEBRUARY 21, 2025

The buy now, pay later product Afterpay became available to eligible cardholders in 20 states Tuesday.

Bank Automation

FEBRUARY 27, 2025

Citizens Bank aims to complete cloud migration by the third quarter as part of its effort to accelerate digitalization and product development. The $217.5 billion Citizens began cloud migration in 2019, Ajay Punia, head of fraud risk and transmissions engineering, told Bank Automation News, adding that more than 80% [of the banks apps] are already […] The post Citizens on pace for 100% cloud migration by Q3 appeared first on Bank Automation News.

The Paypers

FEBRUARY 25, 2025

American Express has announced its partnership with Alipay in order to enable payments at multiple merchants across the region of mainland China.

Fintech Finance

FEBRUARY 24, 2025

MeaWallet , a leader in tokenization and digital payment solutions, announces its partnership with Backbase , the creator of the Engagement Banking Platform. This collaboration aims to deliver innovative tokenization solutions to issuers and fintechs across the Australian and New Zealand markets. The partnership will feature two groundbreaking solutions: Mea Push Provisioning and Mea Card Data.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

PCI Security Standards

FEBRUARY 28, 2025

The PCI Security Standards Council (PCI SSC) is pleased to announce the release of a Frequently Asked Question (FAQ), developed in direct response to industry requests for greater clarity on the new eligibility criteria for the recently revised Self-Assessment Questionnaire (SAQ) A. This update reflects our commitment to supporting the e-commerce community by providing clear, actionable guidance to help businesses meet new requirements under PCI DSS v4.0.1, which take effect on 1 April 2025.

Payments Dive

FEBRUARY 27, 2025

The embedded payments and digital card company agreed to buy European electronic payments provider TransactPay for about $47 million and swapped out its CEO for a Visa alum.

The Fintech Times

FEBRUARY 24, 2025

Women’s investments outperformed men’s by four per cent in 2024, according to Revolut data from its trading customers. New data from Revolut hints towards the beginning of a power shift as women investors saw significantly better returns than men in 2024. While trends like ‘girl math’ started as a bit of lighthearted fun, there is a clear argument that they perpetuate negative stereotypes about young women’s spending and saving habits, as well as about their financi

Finextra

FEBRUARY 24, 2025

The UK Government is considering scrapping the Payments Systems Regulator and folding it into the Financial Conduct Authority.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Fintech News

FEBRUARY 26, 2025

HSBC Holdings has assigned additional responsibilities to country heads in some smaller Asian markets as part of its efforts to streamline operations and eliminate management layers. According to an internal memo seen by Bloomberg News, Peter Kim will take on the role of head of banking alongside his position as chief executive officer in Korea, effective March 1.

Payments Dive

FEBRUARY 21, 2025

Mainly known as a company catering to restaurants, Toast executives said they plan to partner with more food and beverage retailers this year.

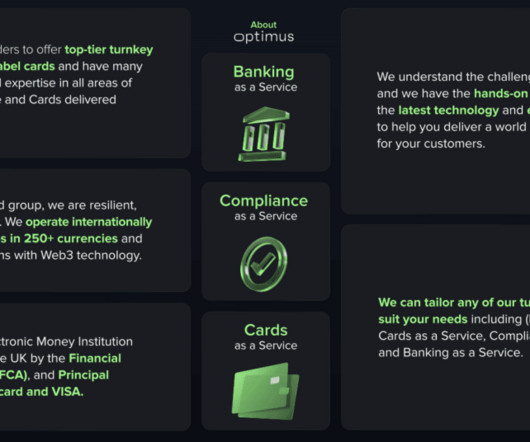

The Payments Association

FEBRUARY 27, 2025

Optimus, a leading regulated technology company specialising in payment solutions, is set for significant growth in 2025. With a revamped commercial strategy and an unwavering commitment to customer-centric solutions, Optimus is primed to solidify its position as a key player in the payments industry. The company’s planned expansion into the European market later this year will mark a significant milestone in its growth trajectory.

Payments Next

FEBRUARY 25, 2025

By Shawn Conahan, CRO, Wildfire Systems The direction of interest rates in 2025 remains uncertain, but one trend is becoming increasingly clear: The post As Credit Card Concerns Rise, Banks Look to Sweeten the Pot for Debit Card Users first appeared on Payments NEXT.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Fintech Finance

FEBRUARY 26, 2025

Network International (Network) ( www.Network.ae ), a leading enabler of digital commerce across the Middle East and Africa (MEA), has been appointed as a Payment Processor – Issuing partner for MTN Group Fintech, Africa’s leading mobile financial services provider. This partnership marks a significant extension of Network’s portfolio of issuer processing collaborations throughout the African continent.

Finextra

FEBRUARY 23, 2025

Coinbase is claiming victory in its long-running tussle with the Securities Exchange Commission, stating that the regulator has agreed to drop its enforcement case against the crypto firm.

Payments Dive

FEBRUARY 26, 2025

Cryptocurrency-focused investment firms and organizations poured capital into the gift card company that says it focuses on “blockchain-powered payments.

The Payments Association

FEBRUARY 25, 2025

Bottomline, a global leader in business payments, has been awarded Cross-Border Payment Company of the Year: North America by International Banker. The category recognises organisations that use innovative technologies, strategic partnerships, and operational excellence to improve financial connectivity worldwide. International Banker relies on nominations from its readers to identify financial institutions and banking technology providers worldwide that demonstrate significant impact and operat

Speaker: David Nisbet, Everett Zufelt, and Michaela Weber

Once upon a time, in the vast realm of online commerce, there lived a humble checkout button overlooked by many. Yet, within its humble click lay the power to transform a mere visitor into a loyal customer. 🧐 💡 Getting checkout right can mark the difference between a successful sale and an abandoned cart, yet many businesses fail to make payments a part of their commerce strategy even when it has a direct impact on revenue.

The Fintech Times

FEBRUARY 24, 2025

Imperial College London will host a workshop on 26 March 2025, exploring the influence of AI, blockchain and quantum computing on the financial services industry. The UKFin+ Spotlight Event at Imperial College London will gather experts from both industry and academia to discuss the transformative impact of emerging technologies. Scheduled from 9am to 4pm, the event will include panel discussions and interactive sessions focusing on the challenges and opportunities presented by these technologie

Fintech Finance

FEBRUARY 21, 2025

With the acceleration of e-commerce, both users and businesses are demanding faster and more instant payments, especially in industries where payments have traditionally been a challenge, such as sports betting and gaming. Just two years ago, users could wait up to three days to access their funds in the bank. Recognizing this opportunity in the payments industry, Cristian Valderrama saw the potential to speed up money collection and disbursement.

Finextra

FEBRUARY 27, 2025

Vanar Chain, the pioneering Layer 1 blockchain, is proud to announce a strategic partnership with Worldpay, a global leader in payments technology, to drive innovation in Web3 payment solutions.

Payments Dive

FEBRUARY 28, 2025

The e-commerce payments company narrowed its losses last year, even as revenue declined. Now, it’s wooing restaurants and retailers through the new tie.

Speaker: Becky Parisotto and John Vurdelja

Fulfillment is no longer just about getting products from point A to point B – it's about crafting seamless, scalable, customer first experiences. Flexible fulfillment strategies are more important than ever for those aiming to stay ahead and build resilience as retail enters a new era in 2025. Learn how to optimize fulfillment processes, tackle complex, multi-vendor orders, and create seamless customer experiences – from white-glove delivery for high-value items to quick-ship solutions for ever

The Payments Association

FEBRUARY 27, 2025

Date: Thursday, March 27, 2025 Time: 08:30-10:30 GMT Location: EY, 25 Churchill Place, Canary Wharf, E14 5EY The next EY payments forum takes place in March, focusing on the regulatory outlook for the payments industry in 2025 and beyond. The event will be hosted by EY payments leaders Abigail Viljoen , Andrew Pilgrim , Alla Gancz , and Genevieve Majoribanks.

Fintech News

FEBRUARY 24, 2025

Ant International has appointed fintech executive Worachat Luxkanalode as the new CEO of Southeast Asian payments company 2C2P, with his tenure set to begin in April 2025, pending regulatory approval. He takes over from founder and current CEO Aung Kyaw Moe, who is stepping down after 22 years to pursue personal projects. Worachat, currently the Managing Director of Grab Thailand, brings extensive experience in financial services and digital banking.

Fintech Finance

FEBRUARY 24, 2025

PPRO , the leading local payments platform, has partnered with European Payments Initiative (EPI) to secure Principal Membership of Europes newest payment method, Wero. Through its Membership, PPRO will provide its customers with the most comprehensive route to access Wero via sponsored associate membership, payment facilitator access, or as a technical gateway.

Let's personalize your content