An Inside Look At Chase’s Mobile Banking Approach

PYMNTS

APRIL 11, 2019

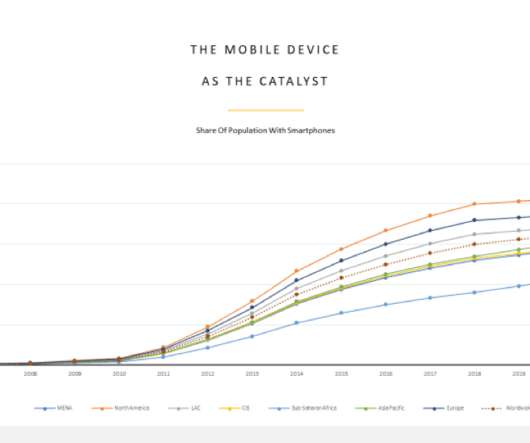

After the June 2007 announcement of Apple’s first-ever iPhone and the ensuing buzz around iOS apps, financial institutions (FIs) began developing offerings to ease digital banking. Twelve years later, however, mobile banking has become ubiquitous across much of the global financial ecosystem.

Let's personalize your content