Fed to review debit card fee cap next week

Payments Dive

OCTOBER 20, 2023

The Fed hasn’t changed a debit card fee cap since it was put in place in 2011, but it's planning to take up the issue at a meeting next week.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

2011 Related Topics

2011 Related Topics

Payments Dive

OCTOBER 20, 2023

The Fed hasn’t changed a debit card fee cap since it was put in place in 2011, but it's planning to take up the issue at a meeting next week.

The Payments Association

JANUARY 22, 2025

Unsurprisingly, this proposal aligns the loosely adopted Payments Services Regulations 2017 (PSRs) and E-Money Regulations 2011 (EMRs) regime with the CASS regime. CP24/20 outlined the proposed interim and end-state rules in September 2024, and interested parties will have provided their feedback accordingly.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Finovate

APRIL 3, 2025

Co-founded by Kristo Krmann and Taavet Hinrikus and launched in 2011, Wise currently boasts 16 million users around the world. Today, the UK-based firm offers an account that individuals and businesses can use to hold more than 50 different currencies, transfer funds between countries, and spend money overseas. billion a year.

Fintech News

MAY 13, 2024

Wong’s tenure with MAS includes his time as Deputy Chairman from 1 June 2021 to 7 July 2023 and as a Board member from 10 June 2011 to 29 August 2016. Wong has held the Chairman position since 8 July 2023 and will step down from his roles as Chairman and Board member on 15 May 2024.

Fintech Finance

APRIL 8, 2025

Established in 2011, the Coordinated Assistance Network (CAN) was founded by Army Veteran John Pickens and Christopher Fitzpatrick and has created impactful support initiatives that connect low-to-moderate income communities to jobs, education, housing, and a more economically secure and equitable future.

Finovate

NOVEMBER 19, 2024

Headquartered in Canada and founded in 2011, Trulioo has raised $475 million. This collaboration provides Trulioo with access to identity and risk scores through a customizable, user-friendly dashboard, expanding its offerings beyond API-based products and further streamlining its onboarding processes.

Finovate

DECEMBER 5, 2024

Mambu was founded in 2011 and emerged as one of the pioneering players to move banking software to the cloud. The company currently processes more than $10.6 billion (10 billion) in payments annually.

Finovate

JANUARY 30, 2025

Wise was founded in 2011 under the name Transferwise to facilitate cross-border payments while bringing transparency to the fees involved. In fact, Wise estimates that from the $147 billion (118.5 billion) in cross-border transactions it facilitated globally last year, it saved customers over $2.2 billion (1.8 The company serves 12.8

Electronic Payments Coalition

FEBRUARY 7, 2024

Since Congress introduced price caps and routing mandates on debit cards in 2011, research from independent and government sources has illuminated their disproportionate negative impact on small businesses.

Fintech News

FEBRUARY 2, 2025

Founded in 2011, Wise was celebrated as a success story in London when it debuted on the London Stock Exchange a decade later. The firm added: While Wise strongly disagrees with the CFPBs characterisation of Wises conduct, we worked with the CFPB in good faith to conclude the matter. However, its global expansion has faced challenges.

Payments Source

OCTOBER 25, 2018

most banks and retailers seemed to have given up on contactless cards with the 2011 demise of the much-publicized Chase Blink brand. In the U.S., But the payment format is making a strong comeback in 2018.

The Paypers

OCTOBER 28, 2024

Bitstamp , a cryptocurrency exchange established in 2011, has received a MiFID Multilateral Trading Facility (MTF) licence.

PYMNTS

SEPTEMBER 1, 2020

The Bank for International Settlements (BIS) said in a recent report that the number of correspondent banks — where banks and financial institutions (and domestic payment systems) are linked together — slipped 3 percent in 2019 vs. 2018 and declined a significant 22 percent from 2011 to 2019.

PYMNTS

JANUARY 25, 2021

percent increase in volume and value, respectively, since 2011. If the RBI develops a digital currency, it could easily help further development in crypto, with the RBI reporting strong growth in digital payments in the country. According to Cointelegraph there has been a 12.5 percent and 4.5

Axway

APRIL 19, 2019

In 2011, DoSomething.org, a non-profit organization, posted a video on YouTube featuring celebrities asking young people to donate used sports equipment to youth in need. That video was viewed by 1.5 million people. Success, you might think? Well, only eight …

Finovate

APRIL 15, 2025

was founded in 2011 to help graduates pay off their student loans while giving businesses a strategic differentiator to improve hiring and employee retention. Student loan benefits platform Tuition.io has received an undisclosed amount of debt financing from ORIX Corporation USAs Growth Capital business. Tuition.io

PYMNTS

APRIL 29, 2020

The WSJ reported a 2011 audit of SBA lending found the agency’s inspector general discovered documentation deficiencies in 40 percent of the loans it reviewed resulting in “inappropriate or unsupported loan approvals.”. Verifying how SBA loans have been used in the past has posed problems for the agency.

Fintech News

SEPTEMBER 3, 2024

He later moved to Visa in Singapore in 2011 and eventually led Visa Latin America’s digital product and money movement initiatives from Miami in 2017. Koker’s career includes key roles in Asia Pacific and Latin America, starting with FIS, where he worked in Manila, Hong Kong, and Bangkok.

Finovate

FEBRUARY 10, 2025

Founded in 2011 and now reaching 900 million people in 190 countries with its technology, Feedzai began 2025 by announcing a partnership with Credibanco to help the Colombian payment processing company strengthen its defenses against fraud. ” Backbase has been a Finovate alum since 2009.

PYMNTS

JULY 1, 2020

In 2011, PYMNTS reported on the Monnet Project , where two dozen European banks from seven countries considered starting a new European card system. This is not the first time that European banks have tried such a model.

Payments Source

JULY 18, 2019

Postmates, which relied solely on Stripe Connect for accepting customer payments for its on-demand delivery service launched in 2011, is adding Adyen as another partner for payments processing.

Fintech News

FEBRUARY 20, 2024

His earlier roles also include leading the Cyber Security Group at the Infocomm Development Authority of Singapore, now known as GovTech, from 2011 to 2015, as well as key positions in IT security at the National Computer Board. Susan Hwee Susan Hwee, NETS Chairman commented, “We are delighted to welcome Mr Yong to our Board.

Fintech News

JULY 30, 2024

Easy Pay Transfers, operating under Malaysia’s Money Services Business Act 2011, offers businesses transparent online payment services. This latest acquisition aims to enhance M-DAQ Global’s capabilities in local payments and deepen its expertise in foreign exchange across the ASEAN region.

PYMNTS

DECEMBER 7, 2020

The company was founded in 2011 and has worked to capitalize on banks' reduced focus on lending after the late 2000s financial crisis, working on refinancing student loans early on and has since also worked on mortgages and personal loans, according to Reuters. SoFi was valued at $4.8

PYMNTS

SEPTEMBER 18, 2020

percent through Q3 2019 and was on pace to be the second-best year following 2011, according to a January report. “If it’s an obviously top 10 percent company, there’s just a huge amount of money being thrown at them by the VC world.". The Prime Unicorn Index increased 58.4

PYMNTS

JULY 22, 2020

In addition, a JLL executive noted in the report that industrial rent growth has been positive as of 2011. In addition, JLL forecasted that the U.S. will require a further 100 million square feet of cold storage space within the few years to come.

PYMNTS

MAY 15, 2019

trillion: Projected annual business travel spend by 2011. trillion: Net amount U.S. firms are owed in accounts receivable on any given day. percent: Firms that regularly use immediate payment services.

PYMNTS

JANUARY 7, 2021

When Mambu launched in 2011, we knew the future of banking would have to be built on agile and flexible technology,” Eugene Danilkis , co-founder and CEO of Mambu, said in a press release. Nearly a decade later, this is more true now than ever, particularly given developments over the past year.”.

Fintech News

APRIL 10, 2024

Temasek’s investment in the EMEA region has seen a significant increase, with the company’s exposure growing nearly fivefold since 2011, reaching S$47 billion (€32 billion), which accounts for 12% of its portfolio as of 31 March 2023.

CB Insights

JULY 1, 2020

Founded in 2011, nCino aims to help financial institutions digitize operations and automate workflows, providing a digital operating system for banks and credit unions. North Carolina-based nCino , a cloud-based banking software company, is going public. Want the full post? Become a CB Insights customer.

Axway

OCTOBER 3, 2023

Le concept d’État-plateforme a été inventé en 2011 par Tim O’Reilly, un entrepreneur et éditeur américain spécialisé dans le numérique. Il a été repris et développé en France par Nicolas Colin et Henri Verdier, deux entrepreneurs du numérique français, dans …

PYMNTS

APRIL 16, 2020

Launched in 2011, Transferwise is Europe’s most valuable FinTech and is known for charging much lower rates than mainstream banks or specialty money transfer services. Menager said PagoFX was “inspired by” One Pay, which the bank ultimately decided against using for its open-market business.

PYMNTS

JUNE 25, 2020

Data: 2011: The year Newegg launched a marketplace model where other sellers accessed its eCommerce platform. And Newegg is mastering the art of the pivot , having piloted a unique business model with a platform that directly connects suppliers and consumers. All this, Today in Data. 186B: Amount of social commerce sales in China in 2019.

Finovate

MAY 15, 2024

Headquartered in Sydney, New South Wales, Australia, Data Zoo was founded in 2011. Founded in 2011, Data Zoo is headquartered in Sydney, New South Wales, Australia. Data Zoo will use the capital to help foster broader adoption of its identity verification technology. Charlie Minutella is CEO.

Fintech Finance

JUNE 18, 2024

Founded in 2011, the global fintech now processes more than US$35 billion of payments each year. The post GoCardless Works With Federation of Small Businesses to Help Its Members Tackle Late Payments appeared first on Fintech Finance.

PYMNTS

OCTOBER 6, 2020

One year ago, Piper Jaffray researchers found that American teens spent $2,371 per year, the lowest level for the age group since the fall of 2011. Teen spending has been on the decline long before the coronavirus brought the economy to a virtual halt. The data, gathered from 9,500 teens across 42 U.S. states, with an average age of 15.8

Finextra

OCTOBER 17, 2024

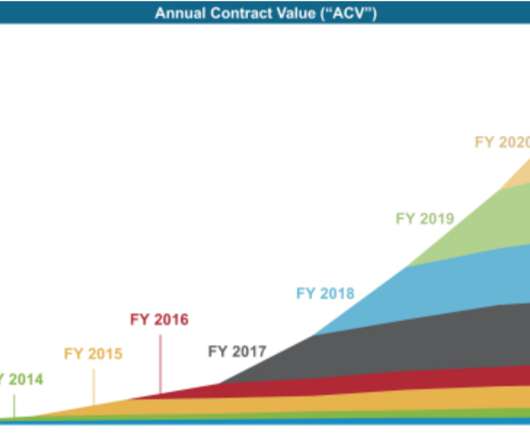

Corner Post, a North Dakota truck stop, is challenging the Federal Reserve’s 2011 rules governing debit interchange revenue established pursuant to the “Durbin Amendment” in the Dodd-Frank Act. The Bank Policy Institute (BPI) and The Clearing House Association filed a motion to intervene today in Corner Post, Inc.

PYMNTS

NOVEMBER 24, 2020

Founded in 2011 by Aman Narang , Jonathan Grimm and Steve Fredette , the startup closed a $400 million funding round in February at a $4.9 The secondary offering gives Boston-headquartered Toast a valuation of about $8 billion, up from a $4.9 billion valuation pre-pandemic in February. billion valuation. .

Fintech Finance

NOVEMBER 18, 2024

The second phase will completely replace the existing safeguarding requirements under the Electronic Money Regulations 2011 and Payment Services Regulations 2017 with a new chapter of CASS, (CASS 15). This phase will put more onus on payment providers to implement better record keeping, reporting and monitoring processes.

Fintech News

MARCH 27, 2024

Since joining as the second employee in 2011, Toy has been instrumental in the firm’s development, culminating in her promotion to partner in mid-2021. Her appointment as COO marks a continuation of her leadership journey, now with a broader mandate to oversee operational excellence and support the firm’s strategic expansion efforts.

PYMNTS

DECEMBER 18, 2020

The social commerce marketplace founded in 2011 connects sellers of used clothing, shoes and accessories to buyers looking for deals. The price range and the number of shares being offered have not yet been determined. Morgan Stanley and Goldman Sachs are leading the offering. Poshmark reports that it has transacted $1.1

Finovate

OCTOBER 4, 2024

Check out this roster of Dutch fintechs that have demoed their innovations on the Finovate stage.

PYMNTS

FEBRUARY 18, 2020

Volocopter was founded in 2011 and is a pioneer in urban air mobility. The startup said it demonstrated in 2011 that electrically powered vertical flight is possible for humans. The collaboration could “eventually extend intermodal mobility to the skies.” .

Neopay

FEBRUARY 5, 2025

This latest communication is particularly relevant to firms authorised under the Payment Services Regulations 2017 (PSRs) and the Electronic Money Regulations 2011 (EMRs), including Electronic Money Institutions (EMIs), Payment Institutions (PIs), and Registered Account Information Service Providers (RAISPs).

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content