US Debit Card Usage Soars as Consumers Embrace Convenient Payments

The Fintech Times

AUGUST 12, 2024

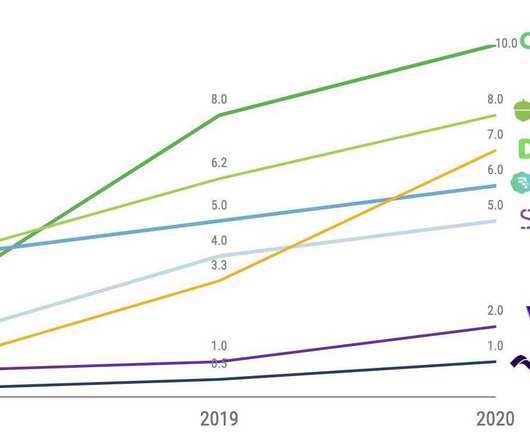

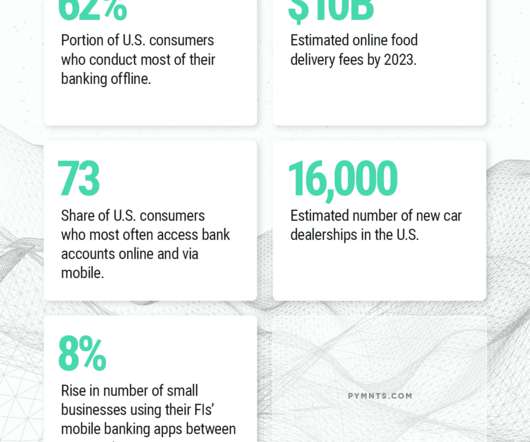

US consumers are increasingly turning to debit cards for their everyday transactions, driving a significant surge in the number of transactions and overall spending. per cent between 2018 and 2023, highlighting the increasing reliance on debit cards as a preferred payment method. On average, active debit cardholders completed 34.6

Let's personalize your content