2018: The Year Of The Confident Consumer

PYMNTS

DECEMBER 29, 2018

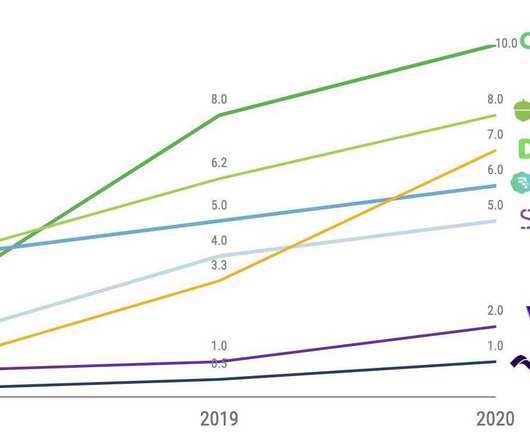

At the close of 2018, the consumer’s outlook on things is several shades brighter than it was a decade ago. Amazon reported a record-breaking holiday season and was reportedly a major beneficiary of confident consumers’ appetite to shut down 2018 with some serious spending. Overall digital sales surged upwards 19 percent in 2018.

Let's personalize your content