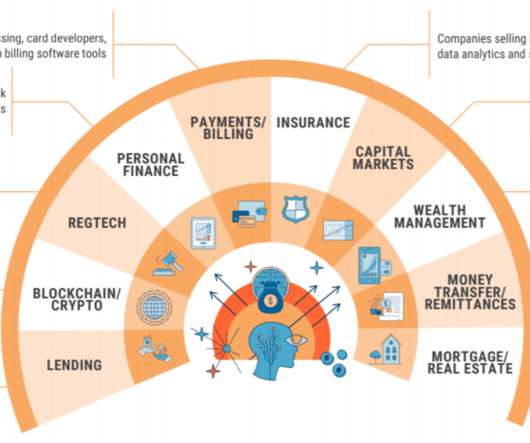

New Research: 58% of Fintechs Now Offer Open Banking Payments as Adoption Rates Continue to Surge

Fintech Finance

JULY 30, 2024

Since its launch in 2018, the adoption of Open Banking payments has also grown among lenders, building societies, and credit unions, with 42%, 17%, and 11% of these businesses respectively listing it on their websites. Just over a third (34%) currently use it to make payments in financial services, while 22% would like to do so in the future.

Let's personalize your content