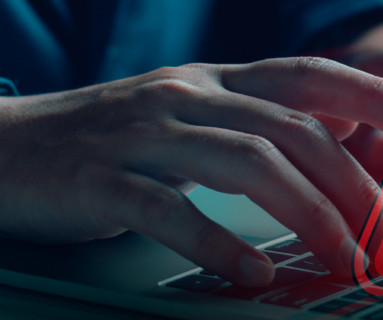

5 security threats to watch in 2019

Payments Source

JANUARY 2, 2019

As consumers grow more attached to mobile devices for e-commerce and payments, fraudsters are intensifying their focus on handsets with new phishing, vishing to SIM-swap tricks.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

PYMNTS

JANUARY 1, 2021

The consumers who shopped for anything from groceries to sporting goods to cars in December of 2019 are completely different from the ones who shop today. Office shifters plan to use digital shopping options more than other consumers after the pandemic has passed,” the report noted. How She Thinks About Vaccines.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

PYMNTS

OCTOBER 13, 2020

“Approximately twice as many consumers shopped for retail products from home in the summer of 2020 as they did in the summer of 2019, and three times as many grocery-shopped from home this summer over last summer, too,” the Report states, giving an idea of scope. Creation of the ‘Superconnected’ Consumer.

PYMNTS

APRIL 10, 2020

citizens and resident aliens who are not claimed as dependents and had gross income below $12,200 ($24,400 for married couples) in 2019, according to the IRS site. The IRS said that the majority of people who filed taxes for 2018 or 2019 will automatically get Economic Impact Payments starting next week.

PYMNTS

NOVEMBER 18, 2020

According to the Fed’s latest quarterly report on household debt and credit, overall consumer debt hit $14.35 August was the six month in a row that saw a drop in consumer credit card balances, the lowest level since 2017. percent in 2019. percent in 2019. trillion, up $87 billion, a 0.6 percent increase over Q2.

Fintech Finance

MARCH 25, 2025

The partnership’s aim is to enhance Fundiin’s risk management capabilities, reduce costs, and expand credit opportunities for Vietnamese consumers, especially the unbanked and underbanked. Founded in 2019, Fundiin was an early entrant into Vietnam’s BNPL sector, offering a fully automated and online payment solution.

PYMNTS

DECEMBER 14, 2020

Consumers’ daily lives look very different now than they did just one year ago. Consumers across the nation have instead hunkered down at home, working, socializing, shopping and paying online. Our research shows that just 20 percent of consumers own eReaders in 2020, for example, down from 23 percent in 2019 and 26 percent in 2018.

PYMNTS

DECEMBER 24, 2020

PYMNTS research on consumer shopping habits showed that 24 percent of all consumers say they have taken at least one of their routine shopping activities online and do not plan to revert to shopping in stores for this activity, even after the pandemic is over. More consumers are going online to shop and pay as the pandemic progresses.

PYMNTS

NOVEMBER 15, 2020

consumers have been paying down payments on credit cards with the pandemic continuing to hamper spending opportunities, which has led to dramatically falling bank card loans, The Financial Times (FT) reports. According to the report, the total amount of card loans in U.S. Revolving debt was down $9.4

PYMNTS

APRIL 12, 2020

People who have not filed tax returns for 2018 or 2019 or do not have direct deposit on file with the IRS, will likely have to wait weeks or months to get a payment, CNN reported.

Fintech Finance

DECEMBER 17, 2024

The Digital Future Forum highlighted the evolving preferences and behaviors of Vietnamese consumers. Increasingly drawn to international travel, luxury purchases, and digital transactions, Vietnamese consumers are part of a strong trend towards experiential consumption.

NFCW

JANUARY 16, 2024

The Swiss central bank’s researchers based their analysis on anonymized, transaction-level data for a large sample of point-of-sale debit card payments made in Switzerland between 2019 and 2021. “In Switzerland – the country we study – the tap-and-go limit was doubled from CHF40 to CHF80 in April 2020.

The Fintech Times

MAY 17, 2024

Consumer payment preferences are constantly evolving, meaning firms need to adapt to cater to these needs. At the Visa Payments Forum in San Francisco, Visa has unveiled new products which will address the evolving consumer payments demands. We’re announcing the next generation of truly digital-native payment card experiences.

Fintech Finance

FEBRUARY 19, 2025

The use of digital wallets has rapidly grown in recent years with the proportion of card transactions using a digital wallet increasing significantly from 11% in 2019 to 35% in 2023. In turn, this could expand the range of alternative payment methods on offer, giving consumers more choice.

Fintech News

JANUARY 21, 2025

Instead, open finance development is being driven by market forces, including consumer demand, fintech innovation, and competitive pressures among financial institutions. Malaysia has also made strides, publishing in 2019 a policy document titled Publishing Open Data using open API.

Payments Dive

OCTOBER 1, 2019

The changing nature of consumers in recent years is raising major questions regarding privacy, loyalty and perceived value in the banking industry, according to a panel of experts at the 2019 Bank Customer Experience Summit.

PYMNTS

JANUARY 11, 2021

The number of eCommerce packages returned soared 70 percent compared to 2019, and because of the pandemic, many customers didn't want to take the items to physical stores, WSJ reported. The option is also determined on a case-by-case basis, depending on the individual customer's purchase history and the cost of processing the return.

Clearly Payments

NOVEMBER 6, 2024

The payment processing market in the United States has demonstrated robust growth, driven by rising consumer demand for digital payments, advancements in financial technology, and the expansion of e-commerce. This growth is driven by increased adoption of digital payment methods, evolving consumer behavior, and an expanding e-commerce sector.

PYMNTS

NOVEMBER 16, 2020

Consumers have cut back on travel, in-person entertainment and restaurant spend. Then they will use this newfound spending power to bring a new, vengeful spending strategy to the holiday season because, after all, the American consumer deserves a few gifts after all that they’ve been through this year. Here’s the scenario.

Innovative Payments Association

DECEMBER 17, 2024

Hill spoke at the IPA’s annual conference in 2019, and while we need to be careful about making predictions based on anything from the pre-pandemic era, his talk does offer some clues as what we might see going forward. In 2019 and in his recent statement, he noted that many financial services issues have bipartisan agreement.

Fintech News

OCTOBER 21, 2024

Initiatives like QRIS (Quick Response Code Indonesian Standard), a national standard for QR code payments launched in 2019, have allowed for standardization, making it easier for businesses and consumers, while collaboration between the government and fintech firms have helped enhance financial inclusion through clear regulations.

Payments Source

JANUARY 17, 2021

The question is not whether things will magically return to the 2019 status quo. The question is: Where is there still pent-up demand among consumers and merchants?

PYMNTS

DECEMBER 23, 2020

Santander Consumer USA was ordered to pay $4.7 million to the Consumer Financial Protection Bureau ( CFPB ) for violating the Fair Credit Reporting Act (FCRA), the CFPB said in a press release. During that time frame, Santander reportedly sent incorrect information on millions of accounts to the CRAs. Aside from the $4.75

PYMNTS

NOVEMBER 30, 2020

The divide between digital and brick-and-mortar commerce hit a tipping point this holiday season, with more consumers than ever going online to kick off their holiday shopping sprees. consumers on Nov. The COVID-19 pandemic accelerated consumers’ shift to digital-first commerce. We surveyed a census-balanced panel of 2,147 U.S.

The Fintech Times

FEBRUARY 19, 2025

Digital wallets represent a “significant opportunity” for consumers, the Financial Conduct Authority (FCA) and Payment Systems Regulator (PSR) revealed as they shared their findings regarding the payment software. Responses raised potential competition, consumer protection and operational resilience issues.

Fintech Finance

JANUARY 16, 2025

As a principal member of major card schemes including Mastercard, Visa, Discover Financial Services, UnionPay International and AMEX, Guavapay is registered as Small Electronic Money Institution (SEMI) with the Financial Conduct Authority (FCA) since 2019.

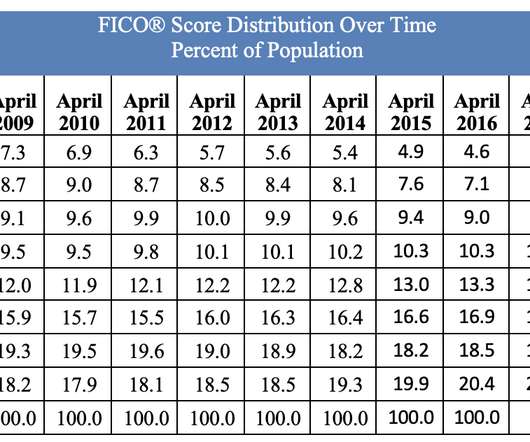

FICO

AUGUST 29, 2022

FICO® Score Stays Steady at 716, as Missed Payments and Consumer Debt Rises. Each year, we provide insight into the national average FICO ® Score to help ensure consumers have a baseline measure of credit health standing. consumer reporting agencies (CRAs). Average U.S. by Ethan Dornhelm. expand_less Back To Top.

The Payments Association

DECEMBER 9, 2024

It underscores the need for payment firms to balance AI innovation with robust privacy and regulatory compliance to protect sensitive consumer data. Payment data is inherently vulnerable because its compromise can have significant financial and personal consequences for consumers. Why is it important? What’s next?

The Fintech Times

NOVEMBER 6, 2024

This will attract and retain an important consumer segment. This growth positions Brazil as the fifth-largest source market for tourists to Peru, surpassing pre-pandemic levels when the country received 100,167 Brazilian visitors during the same period in 2019.

Finovate

APRIL 7, 2025

The move signals growing interest in modernizing collections technology across the financial services industry amid economic uncertainty and evolving consumer behavior. While the amount of the funding was undisclosed, it adds to the $13 million AKUVO has received since it was founded in 2019.

The Payments Association

MARCH 19, 2025

With digital wallets growing in sophistication, consumers and businesses have fundamentally altered how they interact with payments, forcing banks and payment system providers (PSPs) to innovate. This offers transparency in data usage to alleviate consumer concerns.

Fintech Finance

JANUARY 20, 2025

About the 2025 All the Ways Players Pay Research Report Paysafe launched its All the Ways Players Pay research report series in 2019. The 2025 edition was based on a survey conducted on behalf of Paysafe by Sapio Research among 4,300 consumers who have been involved in, or have an interest in, sports betting across six U.S.

PYMNTS

OCTOBER 19, 2020

Consumers across all age demographics have radically realigned their lives over the last eight months. Still, the 2020 edition of the PYMNTS | Visa How We Will Pay consumer survey of a national sample of roughly 10,000 U.S. consumers confirmes that consumers, in fact, have changed. The New Connected Consumers .

Fintech News

JANUARY 13, 2025

Recognising the need to address inefficient practices like manual processing, the Infocomm Media Development Authority implemented InvoiceNow, a nationwide E-invoicing network , in 2019 to help businesses improve efficiency and reduce cost. Automating these processes can benefit SMEs.

PYMNTS

NOVEMBER 23, 2020

Western Union first unveiled the goal of expanding digital payments to 100 countries during its investor day event in 2019. With consumers increasingly turning to online ways of doing things amid the pandemic, Western Union saw its digital revenue jump 45 percent in the third quarter compared to the same period a year ago.

PYMNTS

OCTOBER 13, 2020

Thirty-seven percent more consumers in the United States are working their full-time jobs from home than in 2019, whereas 27 percent more are performing gig jobs remotely. In essence, connected devices are helping turn consumers’ homes into smart, commerce command centers. The world has changed a great deal since 2020 began.

PYMNTS

DECEMBER 4, 2020

The bank also processed record-breaking online and mobile payment transactions on Cyber Monday, up nearly 25 percent over 2019. with 2019 transaction volume exceeding $1.5 That helped offset a 12 percent drop in payment authorizations at physical stores as people continue to largely lock down amid the coronavirus pandemic. “As

The Payments Association

MARCH 18, 2025

As more jurisdictions refine regulations and expand open finance frameworks, the focus will shift to interoperability, consumer trust, and cross-industry data integration. Ultimately, this convergence fosters a more inclusive and efficient financial ecosystem, benefiting consumers and businesses alike. What’s next?

PYMNTS

APRIL 13, 2020

and international) consumer and the businesses that serve them will be center stage as earnings season gets underway, starting, as always, with a slew of big banks. consumer, where spending was strong across cards, where auto loans remained resilient. Overall, consumers made 95 million payments worth $23.8 billion using Zelle.

The Payments Association

OCTOBER 28, 2024

In the world of digital payments, fraud is an ever-present threat that continues to evolve, creating serious risks for both businesses and consumers. These build on the voluntary code in place since 2019 and aim to provide more consistent compensation for victims.

Finovate

APRIL 4, 2025

In their report, Float pointed to legacy banking infrastructure and inefficient processes as the culprit, noting that many companies continued to patronize financial institutions that required time-consuming in-person visits and manual reviews, or long settlement times.

Fintech Finance

MARCH 12, 2025

“This is a clear indication of how the fast and massive adoption of alternative payment channels by consumers in emerging countries is also influencing the credit card industry in these regions,” says João Del Valle , CEO and Co-founder of EBANX. In Mexico, this figure reaches 55%.

Bank Automation

AUGUST 27, 2024

San Francisco-based Wells Fargo appointed Tracy Kerrins as head of consumer technology and leader of the bank’s new generative AI team, according to a July 30 release. Kerrins, who joined Wells Fargo in 2019, has been CIO for consumer technology and enterprise functions technology.

PYMNTS

DECEMBER 16, 2020

A new lawsuit from multiple states alleges that Google used its digital advertising business to harm consumers, The Wall Street Journal (WSJ) reported. This internet Goliath used its power to manipulate the market, destroy competition, and harm YOU, the consumer,” Paxton's office said in a tweet Wednesday (Dec. 16), according to WSJ.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content