Consumer Credit Originations Poised For More Growth In 2019

PYMNTS

DECEMBER 12, 2018

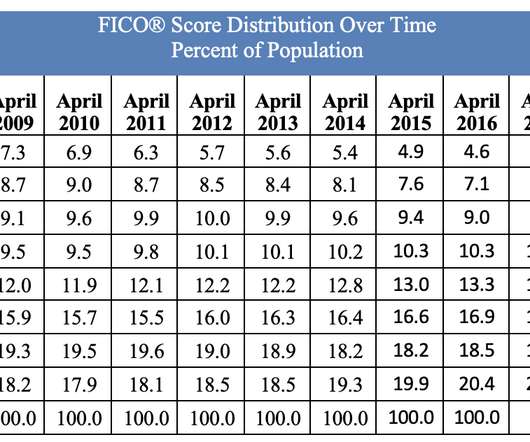

Thanks to low unemployment, growth in GDP and real disposable income, TransUnion forecasted that consumer credit originations and consumer balances will increase in 2019 for the lion’s share of credit products. percent in the fourth quarter of 2019 compared to 1.94 percent in the fourth quarter of 2019 compared to 1.94

Let's personalize your content