Real-Time Payments Will Get Real In The U.S. In 2019

Tom Groenfeldt

MARCH 5, 2019

Real-time payments aren't just faster, they make demands on bank infrastructure and fraud detection.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Tom Groenfeldt

MARCH 5, 2019

Real-time payments aren't just faster, they make demands on bank infrastructure and fraud detection.

Tom Groenfeldt

NOVEMBER 6, 2018

Citizens Bank, an owner bank of TCH, will begin faster payments on its commercial accounts in 2019.

PYMNTS

OCTOBER 14, 2019

Payroll and human resource management solution provider Paychex has unveiled a range of new solutions and services at the 2019 HR Technology Conference & Exposition event late last month. The tool allows Paychex Flex Time users to clock in and out, take breaks and track meals through permission-based GPS location tracking.

PYMNTS

SEPTEMBER 27, 2019

The Federal Reserve’s buildup to faster payments innovation came to a head in August when it announced FedNow , its proposed real-time payments infrastructure under the draft Payments Modernization Act of 2019. payments ecosystem. Competition and Interoperability.

PYMNTS

JANUARY 25, 2019

As they work to achieve this, more companies are ditching paper-based methods and embracing digital solutions that streamline payments and reconciliations. Some financial institutions (FIs) are seeking to help their corporate clients tap into real-time payments (RTP) to keep up the pace. . “We

PYMNTS

JUNE 3, 2020

For this month’s Feature Story, PYMNTS spoke with Tino Kam, head of transaction banking at Finland-based Nordea Bank , and Ulrika Claesson, the bank’s commercial business developer for open banking, about how the need for real-time payments has necessitated equally fast security measures before stolen funds are lost forever.

PYMNTS

JUNE 24, 2019

Everyone seems to want faster payments — from gig workers to B2B suppliers to parents splitting expenses — but with not all major financial institutions on board, real-time payments stand at lower chance for mass adoption. The demand for faster payments is strong in the U.S., transaction accounts.

Fintech Finance

JANUARY 16, 2025

With these accounts, users can send local and international real-time payments at competitive fees. Guavapay provides integrated financial solutions including cross-border and mass payment solutions, enabling customers to send money via SWIFT, SEPA, BACS, CHAPS and Faster Payments.

FICO

JUNE 26, 2018

In the past year, three major economies — the Eurozone, the USA and Australia — have gone live with real-time payments schemes, Canada will follow in 2019 and many other countries are on the road to implementing real-time schemes. Real-Time Payments Equal Real-Time Crime.

PYMNTS

JUNE 17, 2019

In a new partnership, Bottomline Technologies is teaming up with Starling Bank on a Real Time Payments Express Service. The offering will enable corporates and banks to send and receive as well as monitor payments to any U.K. bank account in real time, Crowdfund Insider reported. Those revenues hit $75.5

PYMNTS

DECEMBER 5, 2018

New York-based Signature Bank is rolling out a digital payments platform powered by blockchain that enables real-time payments for corporate customers. 4) the launch of its payments platform, Signet, to provide digital payment services for corporate customers. Shay in a statement.

Fintech News

JANUARY 21, 2025

Initiatives such as ASEAN payment connectivity between Thailand, Singapore, Malaysia, Indonesia and the Philippines, are enhancing economic integration and fostering regional trade by linking real-time payment systems.

FICO

AUGUST 26, 2021

As it happens, there’s a lot more happening in the real-time payments arena than just PayPal, Venmo and Zelle. Let’s take a look at the current trends, with a focus on the US, and how banks can better arm themselves to fight fraud in this rapidly growing payments channel. in addressable payment volume.

The Fintech Times

JULY 31, 2024

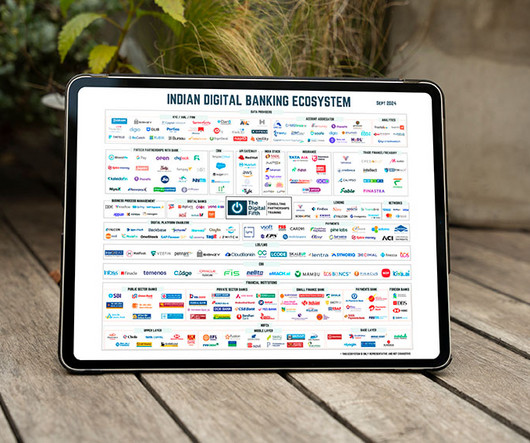

The RBI report highlights that India is leading the way when it comes to real-time payments, boasting a share of 48.5 per cent of the global real-time payments volume. billion transactions in 2019 to 131 billion transactions in 2023 – 80 per cent of all digital payment volumes.

PYMNTS

MAY 10, 2019

The payments company said that before the deal, Visa-enabled payments could only be sent to and from other Visa cards. Is Real-Time Payments a Threat to Credit Cards? Faster, faster, faster – that’s the motto driving so much of payments innovation today. Now you know what payments innovation is like in 2019.

FICO

DECEMBER 19, 2018

My wallet headed into 2019 is about 1/10 th the size it was at the start of the year. My 2019 prediction is that my newly trimmer wallet will be even thinner by next December. I’m predicting that I, along with millions of other consumers, will go cashless in 2019. Most vendors now prefer to accept payment via phone.

FICO

APRIL 20, 2023

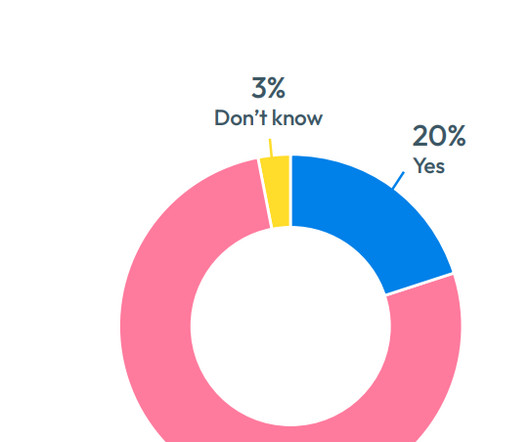

According to FICO’s latest survey of consumers from 14 countries around the globe, 90% of all consumers have sent a real-time payment, and at least 95% of consumers have used real-time payments in India , Indonesia , the Philippines , and Brazil.

PYMNTS

NOVEMBER 25, 2020

Slow payments have long frustrated businesses and consumers, forcing the former to readjust their timelines as they await funds and prompting the latter to put off purchases as they watch for transactions to finalize. Around The Real-Time Payments Space. Bank, representing Elavon , explained in a recent PYMNTS interview.

PYMNTS

JUNE 24, 2019

Major financial institutions (FIs) need to get on board with real-time payment systems for them to achieve widespread availability, while credit unions are finding friendly ground with FinTech firms. 82 percent: Share of businesses that say real-time payments resolve current payment challenges.

Fintech Finance

JANUARY 20, 2025

Looking ahead, players reveal a strong appetite for real-time payments, with 73% expecting this to become the norm at sportsbooks within two years. About the 2025 All the Ways Players Pay Research Report Paysafe launched its All the Ways Players Pay research report series in 2019.

PYMNTS

NOVEMBER 18, 2019

HSBC Bank has launched real-time payments capabilities on the RTP network that gives businesses the ability to pay and be paid immediately, the company said in a press release Monday (Nov. Since July 2019, businesses have been able to receive real-time payments. demand deposit accounts.

PYMNTS

JULY 16, 2019

Now, now, now — that’s the chorus coming from consumers, merchants and other companies when it comes payments, and that demand is fueling progress in real-time payments. It is not only one of the major trends for 2019 but promises to take on increased importance in 2020 and beyond. New RTP Rails. RTP Security.

PYMNTS

JANUARY 22, 2021

"Our strategic partnerships have enabled MoneyGram to create the world's leading network, and this expansion is another milestone on our journey to lead the evolution of digital P2P payments," Alex Holmes, MoneyGram chairman and CEO, said in a press release on Friday (Jan. using Visa Direct. MoneyGram is in favor of a proposal by U.S.

PYMNTS

MARCH 10, 2020

Will this be the year that real-time payments — and, especially, peer-to-peer (P2P) — reach critical mass in the United States? Along with greater participation from these FIs, the number of people sending money using Zelle was up 116 percent, and transactions increased by 207 percent in 2019 as compared to the previous year.

PYMNTS

DECEMBER 24, 2018

But in hopes of hopping on the holiday bandwagon — and providing data-backed insight in the hottest payment trends for 2019 — allow us to offer this list of a dozen ways that consumers (and some businesses) are paying now, methods that promise to play big roles in 2019. 6: With Person-To-Person Mobile Tech.

PYMNTS

AUGUST 6, 2019

would be the latest nation to develop and launch a nationally available real-time payments system. The system, which will be called FedNow, is designed to bring real-time payments capability to the market as a whole, and pick up the pace of money flows nationwide (and beyond).

PYMNTS

JULY 24, 2019

To reinforce the Federal Reserve’s authority to create a real-time payments system and mandate that the Fed brings about its own process, two U.S. senators have introduced the Payment Modernization Act of 2019. representatives and two U.S.

PYMNTS

DECEMBER 30, 2019

Now in its third annual edition, 52 Mondays 2019 showcases those columns. They are presented in the order published — giving you, more or less, a mini payments and commerce time capsule for 2019. And, as always, happy Monday.

The Fintech Times

JANUARY 17, 2025

With these accounts, users can send local and international real-time payments at competitive fees. Guavapay provides integrated financial solutions including cross-border and mass payment solutions, enabling customers to send money via SWIFT, SEPA, BACS, CHAPS and Faster Payments.

FICO

JANUARY 6, 2020

Here are the 5 customer development posts from 2019 with the most views on the FICO Blog. Consumer Banking Predictions 2019: Four Trends to Watch. In 2019, it will become increasingly clear that these transformation projects require more than just new technology, they also require significant organizational changes.”. .

Fintech News

OCTOBER 10, 2024

It offers a suite of financial management tools that integrate with a company’s existing systems to simplify tasks such as payroll, vendor payments, and tax payments, and claims over 45,000 business customers. Fi Money, founded in 2019, targets tech-savvy individuals seeking smarter ways to manage their finances.

PYMNTS

DECEMBER 24, 2020

As the year closes, PYMNTS calls out six payment methods that gained traction and attention, including a take from key executives in each category. If there was a defining trend for payments in 2020, or a trend that gained the most traction compared to 2019, it was buy now, pay later (BNPL). Real-Time Payments.

PYMNTS

SEPTEMBER 9, 2019

Legacy payment cannot meet all five of these requirements — but real-time payments solutions can. The Simplifying Cross-Border Payments Playbook details how payments providers around the globe are tackling this ubiquity problem to bring the benefits of real-time payments to the cross-border payments ecosystem.

Fintech Finance

JUNE 27, 2024

In her position, Hawkins also played a pivotal role in building and commercializing a real-time payments solution. Throughout her career, Hawkins also held executive roles with Fidelity Global Information Services and Metavante Payment Solutions.

PYMNTS

NOVEMBER 30, 2020

When people began experiencing the joy of instant peer-to-peer (P2P) payments a few short years ago, the genie was out of the bottle. Now, the major real-time payments (RTP) players are ready to push the button on real-time, all the time, redefining fast money and revolutionizing multiple aspects of the commercial biome.

PYMNTS

JULY 2, 2019

Real-time payments (RTP) is a global initiative that’s been a decade in the making and counting, one that has gained momentum over the last several years. More than 50 countries are actively pursuing, piloting or already live with real-time payment programs. Regional Change.

The Fintech Times

NOVEMBER 4, 2024

In 2014, Nepal’s central bank, Nepal Rastra Bank , introduced its ‘ National Payment Systems Development Strategy ’ (NPSDS) with a vision to modernise the payment system and develop a secure, robust and efficient payment system. UPI will function for Nepali users like it does for Indians in India.

PYMNTS

OCTOBER 16, 2020

The pandemic appears to be pushing many toward other methods, however, with studies revealing a rising number of companies reporting interest in real-time or instant payment methods. Interest in the Real-Time Payments (RTP) system from The Clearing House (TCH) is growing in the U.S., billion in 2016.

PYMNTS

MARCH 3, 2020

As part of a broader effort to bring the newest innovations to its operations, the National Bank of Fujairah PJSC (NBF) has teamed with blockchain firm Ripple to enable cross-border payments via the RippleNet platform. In 2019, news surfaced that PNC Bank had started to utilize RippleNet to facilitate cross-border transactions.

PYMNTS

MARCH 9, 2020

Payment scheme providers must consider how to encourage adoption, especially if operating in countries lacking a government mandate for financial institutions (FIs) to sign on. Banking association and payments company The Clearing House (TCH) has been confronting such concerns as it advances its real-time payment ( RTP ) offering in the U.S.,

PYMNTS

MARCH 14, 2019

Elsewhere, Forbes said, per an interview with Craig Ramsey, head of real-time payments (RTP) at ACI Worldwide, that 2019 will see “significant” strides in real-time payments. The year] 2019 is about Request For Payment (RFP).

PYMNTS

MARCH 7, 2019

It might be the case that 2019 takes shape as a watershed year for payments regulation, marked by PSD2 and GDPR. Stakeholders in the financial services and payments arenas are navigating new rules about how data is collected, stored and shared. It should come as no surprise that real-time payments remain a focal point.

PYMNTS

SEPTEMBER 10, 2019

These include security and grappling with legacy systems in the embrace of real-time payments. 57: Number of real-time payments schemes operating worldwide in 2019. 72: Number of countries across which payment schemes operate in 2019.

Fintech Finance

JULY 24, 2024

Carl succeeds Michael Bilski, CEO of North American Banking Company, who has served as Board Chairperson since 2019. In his role at BNY, he is responsible for the Treasury Services commercial platform, delivering Payments, Trade & Cash Management solutions to clients globally.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content