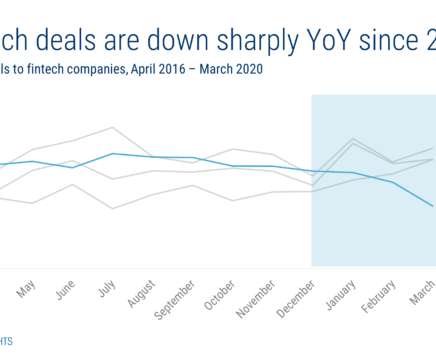

Covid-era contactless payment limit rises drove consumer usage but not adoption, research finds

NFCW

JANUARY 16, 2024

The Swiss central bank’s researchers based their analysis on anonymized, transaction-level data for a large sample of point-of-sale debit card payments made in Switzerland between 2019 and 2021. “In Switzerland – the country we study – the tap-and-go limit was doubled from CHF40 to CHF80 in April 2020.

Let's personalize your content