Deep Dive: How 2020 Shaped The Future Of Digital-First Banking

PYMNTS

DECEMBER 30, 2020

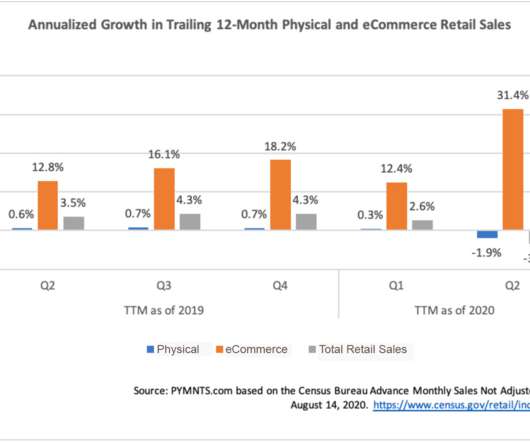

How 2020 Impacted Digital-First Banking. These digital banking trends were already well on their way before the pandemic hit, but mobile banking adoption has skyrocketed in 2020, especially among first-time users. In-branch operations will also likely need to be adjusted to account for the new post-pandemic paradigm. .

Let's personalize your content