Tracking The Trends That Shaped 2020’s The Digital-First Economy

PYMNTS

JANUARY 1, 2021

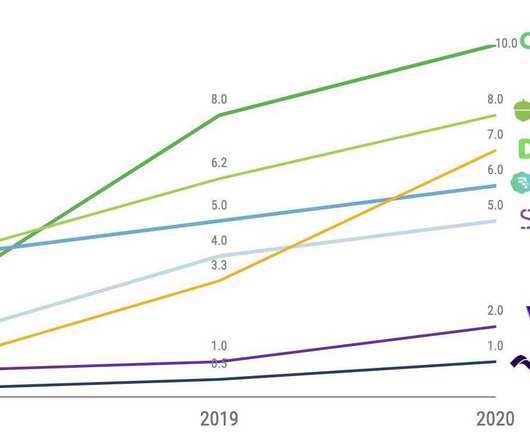

Digital-First Banking. Banks will need to seriously revamp their in-branch experiences to accommodate the new normal as customers are growing used to the unparalleled convenience and speed that mobile banking has to offer. The year-over-year increase in cross-border online sales was even more dramatic in other regions.

Let's personalize your content