What Does 2023 Have in Store for U.S. Credit Risk and FICO Score Trends?

FICO

APRIL 28, 2023

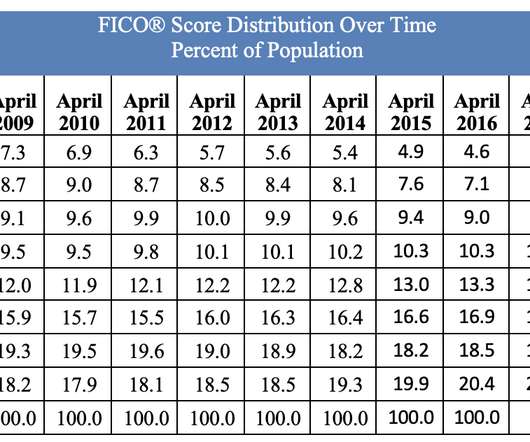

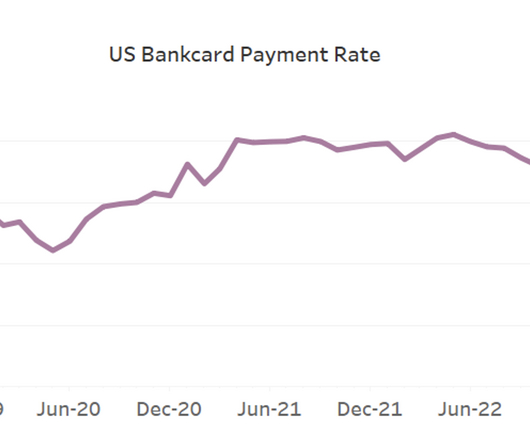

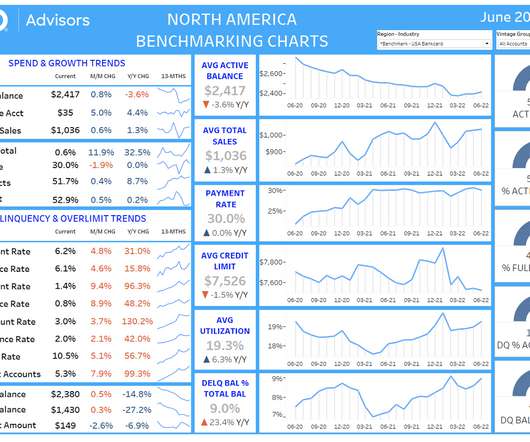

Credit Risk and FICO Score Trends? credit risk and FICO® Score trends. At the same time, increasing adoption of recent innovations in credit scoring solutions should benefit consumers, leading to greater consumer empowerment opportunities and credit access. has remained steady at 716.

Let's personalize your content