Addressing Portfolio Risk in Economic Uncertainty: Part 2 (2022)

FICO

DECEMBER 8, 2022

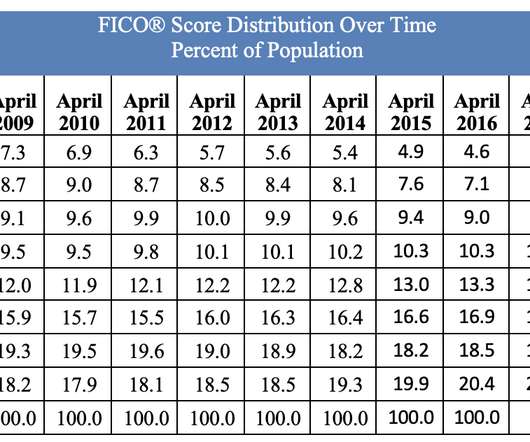

Addressing Portfolio Risk in Economic Uncertainty: Part 2 (2022). Building portfolio risk resilience into customer acquisition. Thu, 12/08/2022 - 16:00. FICO® Scores, often an important contributor to underwriting risk management strategies, are designed to provide valuable risk rank-ordering through all economic cycles.

Let's personalize your content