Digital Fraud Attacks Rise 17% in Financial Services, Driven by Payment and Account Creation Fraud

Fintech News

SEPTEMBER 22, 2024

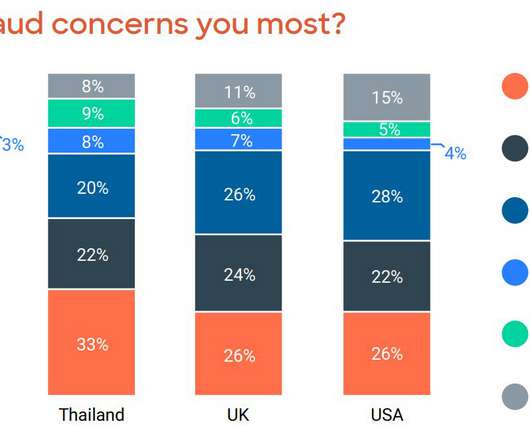

Global highlights: January – December 2023, Source: Confidence Amid Chaos: Managing Fraud and Scams with Data and Analytics, LexisNexis Risk Solutions In financial services, new account creation attacks increased by 12% YoY, driven by increases on the mobile channel, primarily mobile browser. of all cases.

Let's personalize your content