Veriff upgrades biometric authentication solution

The Paypers

JULY 22, 2024

Estonia-based identity verification provider Veriff has augmented its Biometric Authentication solution to prevent account takeover fraud.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

The Paypers

JULY 22, 2024

Estonia-based identity verification provider Veriff has augmented its Biometric Authentication solution to prevent account takeover fraud.

PYMNTS

OCTOBER 13, 2020

The October Digital Identity Tracker ® explores how sellers are adopting biometric-based verification and artificial intelligence (AI) tools to draw in customers and fend off fraudsters. Public officials intended this initiative to give residents a quick, convenient verification process. Around The Digital Identity Ecosystem.

Finovate

OCTOBER 24, 2024

Socure has acquired risk decisioning company Effectiv for $136 million Socure will integrate Effectiv’s AI-powered orchestration platform into its digital identity verification and fraud solutions. Digital identity verification company Socure has acquired risk decisioning company Effectiv in a $136 million deal.

PYMNTS

JUNE 19, 2020

ID verification firm Payfone has completed a $100 million funding round which the company says it will use for strengthening machine learning and building a new consortium to help secure digital transactions, the press release says. The round was led by funds advised by Apax Digital , the growth equity team of Apax Partners.

PYMNTS

SEPTEMBER 17, 2020

Identity verification provider Jumio found in its Global Trust and Safety Survey that one in five U.S. The sharing economy — a market projected to be valued at more than $300 billion by 2025 — can adopt a number of different digital identity verification tools to help build that trust, however. . Seamless, Secure Onboarding .

PYMNTS

SEPTEMBER 18, 2020

Making sure that you are being yourself, so to speak, is the province of ever-smarter authentication systems that verify parties to a transaction and keeping things legit. When you create a new online account, we are capturing an image of the government-issued ID and a 3D face map. Factoring In Authentication.

PYMNTS

DECEMBER 27, 2016

Account takeovers, even of high-profile people, has become a common occurrence in this era of sophisticated cyberattacks and hacks, but researchers think they’ve found a way to fight back against account takeovers : cryptographically based security keys.

PYMNTS

AUGUST 22, 2018

22) that it has rolled out two enhanced consumer authentication solutions, step-up authentication and identity verification, to mitigate card fraud within call centers. In a press release , Fiserv said the two new solutions expand beyond knowledge-based consumer authentication that can be vulnerable to fraud. reached $5.1

PYMNTS

OCTOBER 23, 2017

If people can accept long lines at the TSA and the occasional sore arm at the Minute Clinic, why can’t they accept an extra layer of authentication when using their credit cards online or the need to update their passwords more frequently? They’re using weak passwords – oftentimes, the same weak password for all of their online accounts.

Fi911

JANUARY 18, 2024

They can then open new accounts, apply for loans, or make unauthorized purchases in that person’s name, leaving the victim to deal with the financial and emotional consequences. Multi-Factor Authentication (MFA) Implementing MFA for customer authentication can significantly enhance security. The post What is Third-Party Fraud?

Finovate

AUGUST 14, 2024

Digital identity verification innovator Socure has unveiled its Selfie Reverification solution. Built on the company’s Document Verification (DocV) solution, Selfie Reverification also detects signs of deepfaking, and readily identifies age discrepancies between the photo and the credential.

Fintech Finance

FEBRUARY 29, 2024

Socure , the leading provider of artificial intelligence for digital identity verification, sanction screening and fraud prevention, and Trustly , a leading global Open Banking payments provider, today announced an industry-first partnership to offer merchants and fintechs a streamlined onboarding and guaranteed Pay by Bank solution.

Finovate

AUGUST 27, 2024

Illuma IllumaShield by Illuma streamlines caller verification with a frictionless voice biometrics authentication solution that protects against account takeovers. Any businesses that generate reports.

The Fintech Times

DECEMBER 18, 2023

They predict that social engineering attacks will surpass ransomware in 2024 due to increased sophistication, AI tools and emerging techniques, leading organisations to bolster cybersecurity defences with AI, scenario testing and multi-factor authentication. When you think about it, it’s the high-tech version of social engineering.

The Fintech Times

MAY 17, 2024

New data from Jumio , the automated, AI-driven identity verification and compliance solutions provider, comes from its new 2024 Online Identity Study , the third instalment of its annual global consumer research. To counter the rise in deepfakes and cyber deception, incorporating multimodal, biometric-based verification systems is imperative.

The Fintech Times

FEBRUARY 26, 2024

Enter IAM platform convergence Many financial institutions still rely on home-grown and/or legacy Identity and Access Management (IAM) solutions to meet their authentication, identity verification and authorisation needs. Customer experience : They excel at streamlined, connected journeys, leaving clunky interfaces in the dust.

PYMNTS

JULY 17, 2020

Identity verification and authentication solutions help financial institutions (FIs) block out fraudsters, but leveraging just one or two of these offerings may not be enough. Some FIs are therefore using digital identity networks that help them access and draw insights from a wide variety of verification tools.

PYMNTS

AUGUST 7, 2019

At this point in 2019, we’ve all dealt with some flavor of two-factor authentication that uses SMS one-time passcodes. It is perhaps easy to beat up on SMS-based authentication for how relatively easy it is to overcome — but it is perhaps a bit unreasonable to expect it to act as an authentication method.

FICO

JANUARY 11, 2021

Identity-based fraud takes many forms: application fraud , bust-out fraud , account takeover , synthetic identities and identity theft. Because humans are involved, the thoroughness of document verification varies based on the person performing this manual process. Build consumer trust in digital identity verification processes.

PYMNTS

SEPTEMBER 24, 2020

Without in-person interactions with bank staff, account takeovers (ATOs) and customer impersonations are much easier for fraudsters to accomplish. Identity fraud accounted for $16.9 A major factor in this decline has been the rise of improved authentication and security systems at banks like Axis.

PYMNTS

JULY 9, 2019

In an new PYMNTS interview, Reinhard Hochrieser, vice president of product management at authentication services provider Jumio , provided an overview of the global state of ID verification and authentication, along with access management — and how improving those processes and technology can lead to gains for merchants and financial institutions.

Clearly Payments

JULY 16, 2024

To mitigate these risks, retailers can implement robust authentication measures, invest in secure payment gateways , and educate customers about secure online shopping practices. According to the Association of Certified Fraud Examiners (ACFE) , financial institutions account for 16.8% of all reported fraud cases. billion in losses.

PYMNTS

JUNE 25, 2018

Cybercriminals have a new favorite weapon in their quest to allude regulators, law enforcement and corporate security departments: account takeovers. Recent research reveals account takeovers have risen by 300 percent over the past year, with losses topping $5 billion. The Rise Of Account Takeovers.

PYMNTS

SEPTEMBER 24, 2020

In a Masterclass interview with PYMNTS, Tom Donlea , vice president and general manager, APAC at global identity verification provider Ekata , said Asia offers greenfield opportunities — and some areas of risk — for merchants looking to offer digital wallets.

PYMNTS

JANUARY 16, 2020

Trade finance and supply chain digitalization company Tradeshift has partnered with fraud protection solutions firm SiS to ward against this, developing a solution that uses blockchain technology for more robust identity verification. Experimentation with biometrics and other behavioral analysis tools is also advancing.

PYMNTS

AUGUST 10, 2020

Biometric identity verification is proving perhaps the best weapon we have to defend against the synthetic frauds and deep fakes that are starting to dominate cybercrime. “By These methods could be especially useful for online age-verification processes, as biometric measures are highly accurate and difficult to fake.”.

PYMNTS

MAY 24, 2017

This all comes as no surprise to Brett McDowell, who is working with a team of corporations in verticals from financial services to software to take human error out of the authentication equation, as part of the FIDO Alliance. Because once hackers get their hands on the information, it’s already too late to stop them.

FICO

DECEMBER 19, 2022

As customer interactions go completely online, digital identity verification and authentication help — but sophisticated authentication can’t stop all types of fraud. The risks of answering either question wrong should encourage financial institutions to rethink a few things, including: How and when they authenticate customers.

PYMNTS

APRIL 12, 2017

The need for online retailers and brands to be vigilant in the face of fraud becomes more pressing by the day — but additional authentication measures can create friction on the consumer’s end, which has a nasty habit of reducing conversion rates. At the moment, Bonin said XOR holds about 1.8 billion records from various major breaches.

FICO

APRIL 8, 2020

Identity Verification. The digital identity verification equivalent enables a “selfie” sent by the applicant to be accurately compared with the photo of their identity document. Together identity validation and identity verification are often referred to as identity proofing. Enrollment.

PYMNTS

JUNE 13, 2019

One of the latest involves hackers successfully accomplishing account takeovers (ATOs) of users of Zelle, the digital payment service. acquire personal data via account takeovers. Fingerprints, voice prints and other forms of biometric authentication are gaining steam in the arsenal of fraud-fighting tools.

PYMNTS

APRIL 22, 2020

FIs should thus consider which details they are using during this process, as access to valid and current data is critical, and its impact on authentication and customer satisfaction has grown as more users start asking for digital banking services over in-person ones. Data and Authentication Frustrations. Biometrics and Onboarding.

PYMNTS

MARCH 20, 2020

Many are turning to artificial intelligence (AI), machine learning (ML) and other advanced learning solutions to prevent and detect breaches before they can cause large-scale problems, but bad actors are using the same set of tools to sidestep authentication processes or impersonate legitimate customers.

Seon

JUNE 24, 2024

Credit card fraud accounted for 34% of these statistics, indicating fraud’s pervasive and industry-agnostic nature. Cybercriminals often employ sophisticated tactics, such as synthetic identities, account takeovers (ATOs) and exploiting unsuspecting individuals through socially engineered schemes.

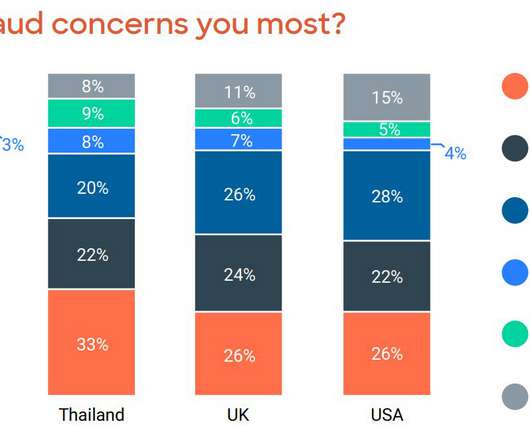

FICO

SEPTEMBER 8, 2022

One of the issues is that the platform is often used for transacting small dollar amounts, where hardly any authentication or verification checks are used, making users more vulnerable to fraud. A further quarter (26%) of customers dislike banks changing the methods used to authenticate customers.

PYMNTS

FEBRUARY 14, 2020

Orchestrating Complex Authentication And Fraud Decisioning. One way to authenticate consumers and block cybercriminals is thus no longer enough for businesses to protect their users, as fraudsters begin to create attack strategies that can carefully bypass more simplistic verification measures. About the Playbook.

PYMNTS

JUNE 22, 2020

Consider the fact that, as estimated by Javelin Strategy and Research, the combined estimated losses of new account fraud and account takeover in the U.S. Such authentication is crucial in streamlining the decisioning process and advancing “good” applications while reducing false positives. alone topped $10.2

PYMNTS

FEBRUARY 22, 2019

The fallout hits everyone involved via a fraudulent transaction, and, as the data shows, account takeovers are on the rise. That’s especially true along the traditional and current methods of authentication , he said. Nowadays, verification spans many conduits and data points — including something the consumer is (i.e.,

PYMNTS

MAY 5, 2020

In an interview with PYMNTS, Mitch Pangretic, senior vice president of strategic partnerships at Elan , said that in-person card fraud may have decreased thanks to EMV chips and multi-factor authentication, but card-not-present (CNP) scams are increasingly gaining traction. Interacting With The Cardmember.

PYMNTS

AUGUST 7, 2020

The following Deep Dive examines how fraudsters’ schemes target gamers as well as how data breaches enable bad actors to commit account takeover (ATO) fraud. These methods could be especially useful for online age-verification processes, as biometric measures are highly accurate and difficult to fake. .

PYMNTS

JANUARY 24, 2020

Merchants can better trust transactions made with cards issued by firms with strong authentication approaches, for example. . This is “because that trust should be derived through the payment channel [as well as] through authentication capabilities, [bridging] the issuer to the merchant, and folks like Worldpay facilitate those connections.

PYMNTS

SEPTEMBER 6, 2019

The need for newer, stringent authentication comes as call centers — especially those for banks and other financial services — are getting hit with increasingly sophisticated fraud. Users’ voices, how they hold their phones or type and their fingerprints are all factors call centers are examining for more secure authentication.

PYMNTS

SEPTEMBER 25, 2019

And it may be the case that in the tradeoff between convenience and security, companies would do well to start looking harder into whether identity verification efforts need to be stepped up a bit, even if that means injecting friction into the equation. As Ritter noted, email accounts are the first avenues of attack for fraudsters.

PYMNTS

MAY 3, 2016

Digital biometric technology and authentication provider mSIGNIA announced on Monday (May 2) that it was issued U.S. When online services use mSIGNIA’s digital biometric platform as the first method of authentication, it reduces the need for other authentication methods that can disrupt the user experience.”.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content