Visa Ramps Up AI-Powered Fraud Prevention During Holiday Shopping Globally

Fintech News

DECEMBER 17, 2024

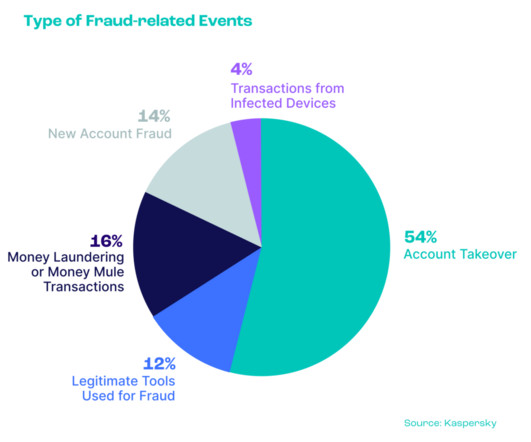

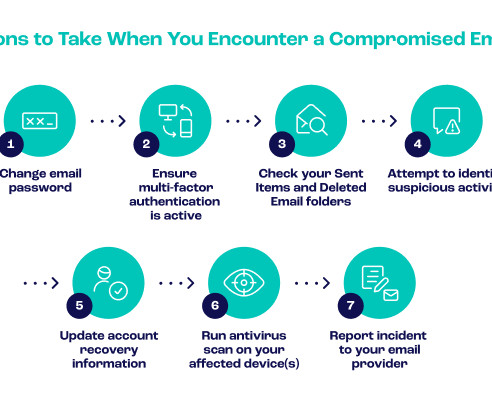

Visa announced that its fraud prevention system blocked nearly 85% more suspected fraudulent transactions globally this Cyber Monday compared to the same day last year. This solution, launched earlier this year, leverages generative AI to help prevent account takeovers and other types of fraud across shopping platforms.

Let's personalize your content