Taking the Preemptive Strike to Thwart Rising Scams and Fraud in ASEAN Banking

Fintech News

JUNE 6, 2024

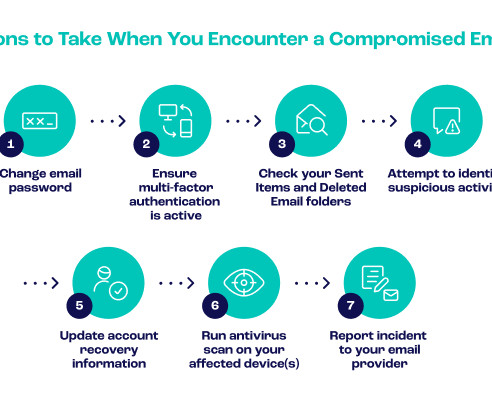

In recent years, the banking sector in the Association of Southeast Asian Nations (ASEAN) has witnessed a significant surge in scams and fraud activities. DBS isn’t the only bank making news for phishing scams. US$129,841). Losses exceeded S$13 million (US$9.59 Losses exceeded S$13 million (US$9.59

Let's personalize your content