What Is Account Takeover Fraud (ATO)? Detection & Prevention

Seon

JANUARY 29, 2024

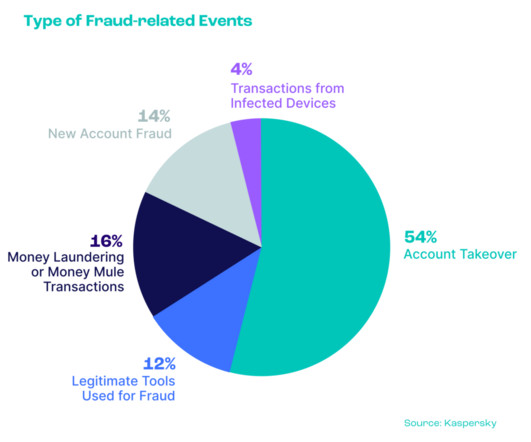

In this guide, we’ll see why accounts are targeted, how fraudsters acquire them, and, of course, which steps you should take to secure them. This is your complete guide to understanding and detecting account takeover (ATO) fraud in your business. What Is Account Takeover Fraud?

Let's personalize your content