DocuSign Wages War On Phishing

PYMNTS

JANUARY 23, 2020

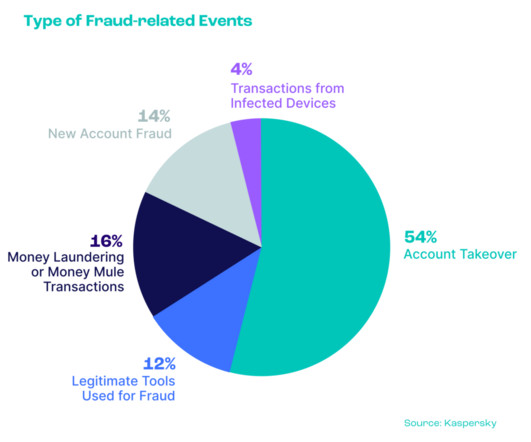

billion consumer accounts fell victim to data breaches during the first half of 2019 — to the tune of $4 million in lost revenue per breach. Phishing attempts increased approximately 65 percent in 2019, and cost businesses more than $12 billion in stolen funds, victim payouts and opportunity costs. More than 4.1

Let's personalize your content