Entersekt recognized as leading vendor for account takeover prevention in banking by Liminal

The Payments Association

AUGUST 7, 2024

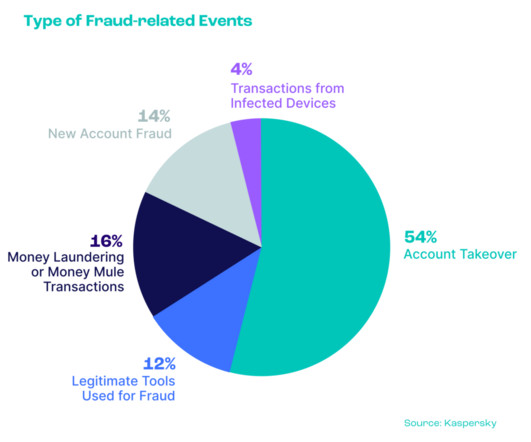

Entersekt was recognised as a Leading Vendor, and highest rated Authentication-Focused Vendor, in the July 2024 Liminal Link Index for Account Takeover (ATO) Prevention in Banking report. Read more

Let's personalize your content