Understanding Account Takeover Fraud: Prevention & Protection Strategies

Fraud.net

MARCH 1, 2024

Understand the mechanics of account takeover fraud and discover effective prevention strategies to safeguard against ATO attacks.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Fraud.net

MARCH 1, 2024

Understand the mechanics of account takeover fraud and discover effective prevention strategies to safeguard against ATO attacks.

Finextra

MARCH 20, 2024

Sumsub, a leading global full-cycle verification platform, commits to tackling the alarming surge of fraud networks in Asia-Pacific (APAC) by launching its upgraded Fraud Prevention Solution.

The Fintech Times

JUNE 2, 2024

Fraud prevention decision-makers across Europe are well aware of the growth and danger of AI-driven identity and financial fraud, but are unprepared to combat it, Signicat , the European digital identity and fraud prevention solution provider, has revealed in a new report.

Fintech News

MARCH 20, 2024

Sumsub, a global verification provider, is addressing the sharp increase in fraud networks in the Asia-Pacific (APAC) region with its enhanced Fraud Prevention Solution. This tool is designed to help businesses tackle fraud rings, account takeovers, chargeback fraud, and bot attacks.

The Payments Association

DECEMBER 11, 2024

Digital payments demand advanced fraud prevention, blending AI and human intelligence to counter evolving threats while ensuring seamless user experiences. Multifaceted approaches to fraud prevention Effective fraud prevention now requires a combination of technological and human intelligence, transcending traditional security models.

Fintech News

MAY 27, 2024

This technology enables fraudsters to exploit vulnerabilities in fintech platforms, necessitating advanced fraud prevention strategies. According to a report by McKinsey, APAC accounted for nearly 40% of the global BNPL transaction volume in 2020.

PYMNTS

OCTOBER 23, 2017

And yet, despite headlines featuring Equifax, Sonic, Deloitte and Whole Foods – and cybersecurity companies consistently preaching that attacks are not a matter of “if” but “when” – many organizations are still not taking fraud prevention seriously. Account takeover is not entry-level fraud. Growth Trajectory.

PYMNTS

JULY 2, 2020

But the bad news is that fraudsters see a once-in-a-lifetime opportunity to jump into the increased flow of transactions, Gary Sevounts , executive at fraud detection firm Kount , told PYMNTS in a recent conversation. He added that fraudsters have been showing up across the board in terms of fraud types attempted.

PYMNTS

SEPTEMBER 24, 2020

In a Masterclass interview with PYMNTS, Tom Donlea , vice president and general manager, APAC at global identity verification provider Ekata , said Asia offers greenfield opportunities — and some areas of risk — for merchants looking to offer digital wallets. Every recession leads to an increase in fraud ,” he said.

Finovate

OCTOBER 24, 2024

Socure has acquired risk decisioning company Effectiv for $136 million Socure will integrate Effectiv’s AI-powered orchestration platform into its digital identity verification and fraud solutions. Digital identity verification company Socure has acquired risk decisioning company Effectiv in a $136 million deal.

Fi911

DECEMBER 3, 2024

One vital tool that should be in every merchant’s arsenal is the velocity check, also known as velocity control, a precise and dynamic fraud prevention measure. Velocity checks serve as an integral part of a comprehensive fraud prevention strategy.

Fintech News

JUNE 6, 2024

. “Many financial organisations are already adopting biometric and liveness detection technologies to strengthen their fraud prevention systems,” said Frederic Ho, Vice President of APAC at Jumio. The benefits of digital identity verification extend beyond just enhanced security.

PYMNTS

SEPTEMBER 24, 2020

Without in-person interactions with bank staff, account takeovers (ATOs) and customer impersonations are much easier for fraudsters to accomplish. This does not mean that just one layer of security is sufficient for fraud prevention, however. Suddenly one day you do a transaction worth $5,000.

The Fintech Times

DECEMBER 18, 2023

Rise in social engineering Doriel Abrahams, head of risk, Forter Doriel Abrahams , head of risk at payment optimisation and fraud prevention platform Forter, also expects social engineering will “take a giant leap forward” in 2024. Our expectation is that social engineering attacks will only increase further in 2024.”

FICO

FEBRUARY 16, 2022

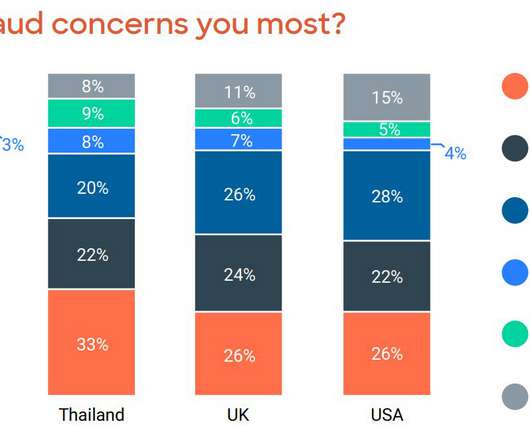

FICO published our 2021 Digital Consumer Banking and Fraud Survey today that emphasizes consumer perspectives on customer experience and fraud prevention management. . US customers and their banks are familiar with different types of fraud including card, identity, and payment related frauds.

Fintech Finance

FEBRUARY 29, 2024

Socure , the leading provider of artificial intelligence for digital identity verification, sanction screening and fraud prevention, and Trustly , a leading global Open Banking payments provider, today announced an industry-first partnership to offer merchants and fintechs a streamlined onboarding and guaranteed Pay by Bank solution.

PYMNTS

MARCH 20, 2020

Madrid, Spain-based security firm buguroo is combatting account opening fraud with its bugFraud solution, which uses deep learning to detect fraud by measuring how application processes compare to legitimate transactions. A surp rising tactic is emerging to thwart such preventative efforts, however.

Finovate

AUGUST 14, 2024

Digital identity verification innovator Socure has unveiled its Selfie Reverification solution. Built on the company’s Document Verification (DocV) solution, Selfie Reverification also detects signs of deepfaking, and readily identifies age discrepancies between the photo and the credential.

PYMNTS

JUNE 25, 2018

Cybercriminals have a new favorite weapon in their quest to allude regulators, law enforcement and corporate security departments: account takeovers. Recent research reveals account takeovers have risen by 300 percent over the past year, with losses topping $5 billion. The Rise Of Account Takeovers.

The Fintech Times

AUGUST 17, 2024

Empowering businesses NeuroID’s behavioural analytics solutions are available through CrossCore on the Experian Ascend Technology Platform as a key fraud-detection capability. Experian’s identity verification and fraud prevention solutions helped clients avoid an estimated $15billion in fraud losses globally last year.

PYMNTS

JANUARY 27, 2020

Payment service providers (PSPs) must carefully attend to their know your customer (KYC) and know your customer’s customer (KYCC) checks, anti-money laundering (AML) strategies and other fraud prevention approaches. Identity Verification and Confirmation .

PYMNTS

FEBRUARY 14, 2020

The fraud prevention race is the same as it has always been, with merchants and security companies sprinting to stay ahead of cybercriminals to keep data safe and secure. Although fraud losses from banks, retailers and online platforms have continued into 2020, so has security innovation.

PYMNTS

JANUARY 23, 2020

Many of these data breaches are the result of phishing, which dupes victims into giving up login credentials or other sensitive information that is either used for account takeovers or sold on dark-web marketplaces. is facing fraud problems as well. How DocuSign Ices Out Phishing Attacks.

PYMNTS

AUGUST 22, 2018

22) that it has rolled out two enhanced consumer authentication solutions, step-up authentication and identity verification, to mitigate card fraud within call centers. In a press release , Fiserv said the two new solutions expand beyond knowledge-based consumer authentication that can be vulnerable to fraud. reached $5.1

PYMNTS

SEPTEMBER 25, 2019

And it may be the case that in the tradeoff between convenience and security, companies would do well to start looking harder into whether identity verification efforts need to be stepped up a bit, even if that means injecting friction into the equation. As Ritter noted, email accounts are the first avenues of attack for fraudsters.

PYMNTS

OCTOBER 1, 2019

In the study, the most common challenge cited by businesses was balancing fraud prevention and customer friction (68 percent), a 65 percent increase from the previous year. Mobile device attributes for verification took the lead (44 percent), followed by artificial intelligence (42 percent) and machine learning (41 percent).

PYMNTS

AUGUST 7, 2020

Eighty-eight percent of surveyed managers expect the health crisis to increase the threat of financial fraud in regulated industries, including online gambling. . The following Deep Dive examines how fraudsters’ schemes target gamers as well as how data breaches enable bad actors to commit account takeover (ATO) fraud.

PYMNTS

MAY 5, 2020

“This can really create a proactive communications strategy to significantly decrease the incidence of successful fraud attempts,” said Pangretic. On the “back end” of the business, Elan leverages state-of-the-art fraud detection tools to identify and prevent transactional fraud, account takeover and fraudulent applications.

FICO

FEBRUARY 16, 2022

FICO published our 2021 Digital Consumer Banking and Fraud Survey today that emphasizes consumer perspectives on customer experience and fraud prevention management. . US customers and their banks are familiar with different types of fraud including card, identity, and payment related frauds.

Seon

JULY 10, 2024

These may include various types of fraud, such as identity theft, account takeover, payment fraud and application fraud. Fraud transaction monitoring’s scope is narrow. For fraud prevention, these systems detect unusual patterns or suspicious activities indicative of fraudulent transactions.

Fraud.net

MARCH 29, 2024

Discover advanced fraud detection systems used by banks and explore the solutions offered by Fraud.net for proactive fraud prevention.

PYMNTS

FEBRUARY 11, 2020

The future of eCommerce, and fraud prevention, is flipping the script from just stopping bad transactions to enabling personalized customer experiences. That is why legacy fraud prevention tools are becoming less and less efficient and effective.”.

PYMNTS

MARCH 30, 2016

Because Guardian CyberShield offers a comprehensive layered payment fraud solution to stop fraudulent transactions, this enables companies to reduce chargeback costs. It is also used to prevent account takeover, payment fraud, identity spoofing, malware and data breaches.

Seon

MAY 28, 2024

The importance of robust fraud prevention and anti-money laundering (AML) solutions in the iGaming sector cannot be overstated. There is an opportunity to boost profitability by refining fraud prevention and AML efforts. Strengthen Fraud Defenses Elevate iGaming security with advanced fraud and AML.

PYMNTS

OCTOBER 28, 2019

Identity verification solutions provider GIACT Systems has announced the launch of an automated identity monitoring service called gIDENTIFY Persistent Monitoring, the company announced in a press release on Monday (Oct.

PYMNTS

JUNE 13, 2019

If it seems like cases of fraud and hacking are always in the news, that’s because new incidents pop up practically every day. One of the latest involves hackers successfully accomplishing account takeovers (ATOs) of users of Zelle, the digital payment service. acquire personal data via account takeovers.

PYMNTS

JANUARY 16, 2020

Trade finance and supply chain digitalization company Tradeshift has partnered with fraud protection solutions firm SiS to ward against this, developing a solution that uses blockchain technology for more robust identity verification. Experimentation with biometrics and other behavioral analysis tools is also advancing.

The Fintech Times

AUGUST 13, 2024

Behavioural biometrics Other key AI-powered fraud prevention approaches gaining traction in the region include behavioural biometrics to detect account takeovers. Infrastructural gaps, talent shortages, and evolving regulatory frameworks have also hindered AI readiness in combating fraud.

Clearly Payments

JULY 16, 2024

Fraud Rate by Industry in 2023 Credit card fraud is a pervasive issue impacting various industries, each with unique vulnerabilities and estimated fraud rates. Rank Industry Fraud Rate Most Common Fraud Type 1 Travel and Hospitality 3.2% of all reported fraud cases. billion in losses.

FICO

SEPTEMBER 8, 2022

Real-time payment systems such as India’s Unified Payments Interface (UPI) have been a prime target for fraud as transaction volume on the platform grows at a breakneck pace. Balancing Strong Fraud Protection with Convenience. Implementing effective account security technologies that reduce friction is therefore a priority.

FICO

JULY 28, 2021

NACHA Steps Up Its Fraud Prevention Requirements. In response to a rise in fraudulent activity targeting ACH and other electronic transactions, the WEB Debit Account Validation Rule was put into effect by NACHA on March 19, 2021. If the transaction arrives, it qualifies as a status check for that account. Source: NACHA.

PYMNTS

SEPTEMBER 28, 2017

In a conversation with PYMNTS’ Karen Webster, David Barnhardt, executive vice president of product at full-service payment and ID verification solutions provider GIACT Systems , said the estimated costs of synthetic identity fraud to credit card firms will come in at $8.5 billion in credit card charge-offs in the next year alone.

Nanonets

MAY 31, 2023

Common examples of external payment fraud include: Impersonation: Fraudsters pose as legitimate customers or vendors to deceive organizations into making unauthorized payments. Account Takeover: Criminals gain unauthorized access to customer accounts, allowing them to make fraudulent transactions or transfer funds.

PYMNTS

MAY 24, 2017

“Any authentication credential should have some characteristic where the user cannot be tricked into giving it to a fraudster or to any party that would abuse the service, whether it’s an account takeover, a ransomware attack or anything else.” McDowell explained.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content