Introducing Journal Entry Management: Adding Controls and Streamlining Accounting

FloQast

DECEMBER 4, 2024

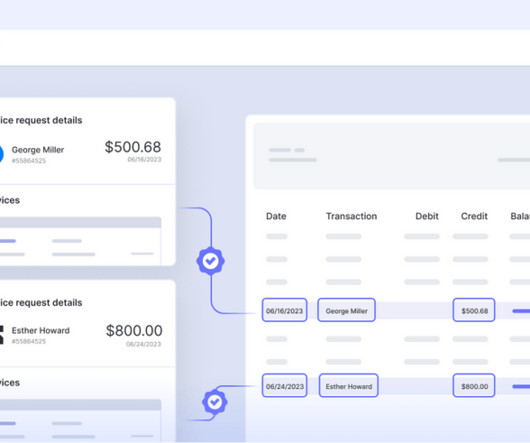

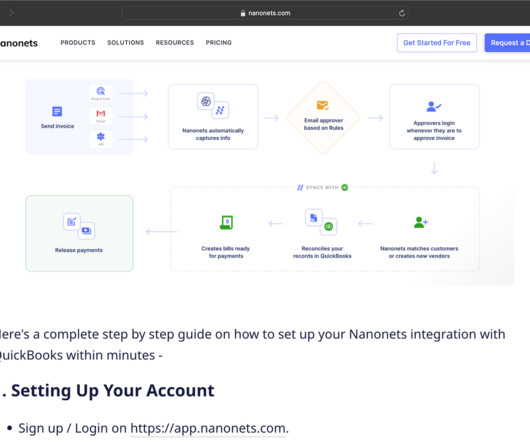

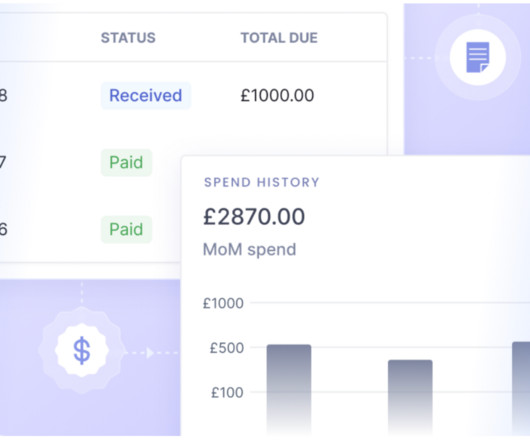

In today’s fast-paced financial world, accounting teams are under pressure to ensure accuracy, compliance, and speed — all while managing increasingly complex data. Part of FloQast’s Accounting Transformation Platform , this new tool is designed to simplify and automate journal entry workflows, reducing errors and saving time.

Let's personalize your content