What is Accounts Payable (AP) Automation?

Nanonets

FEBRUARY 1, 2024

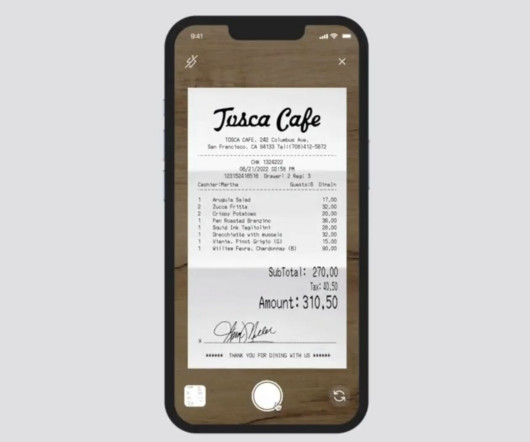

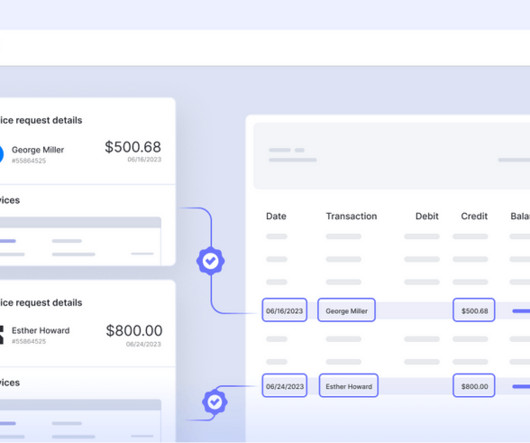

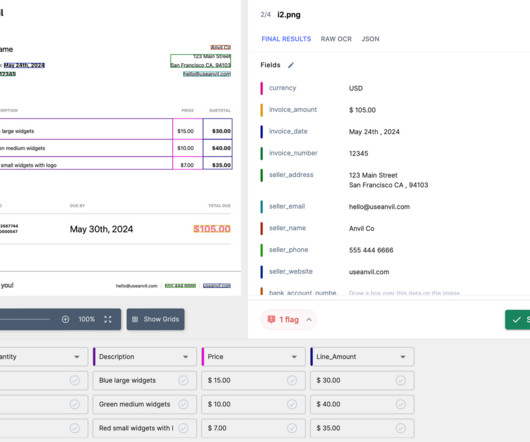

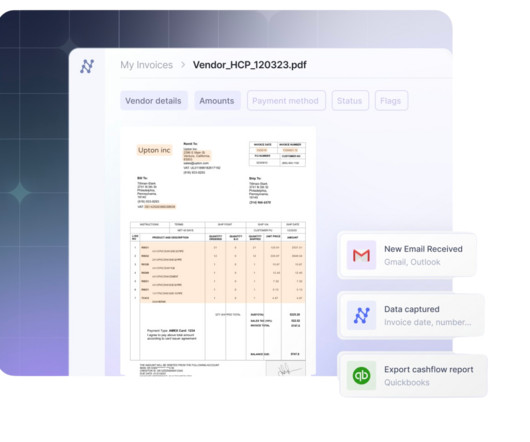

In the rapidly evolving business landscape, the efficiency of Accounts Payable (AP) processes is no longer just a back-office concern but a strategic imperative. Accounts Payable (AP) automation is the use of technology to streamline and improve the process of managing a company's bills and payments owed to others.

Let's personalize your content