Same-day ACH payments soar

Payments Dive

APRIL 20, 2023

The dollar value of same-day ACH payments nearly doubled in the first quarter as the volume increased 20.7%, Nacha said this week in a quarterly update.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

ACH Related Topics

ACH Related Topics

Payments Dive

APRIL 20, 2023

The dollar value of same-day ACH payments nearly doubled in the first quarter as the volume increased 20.7%, Nacha said this week in a quarterly update.

Payments Dive

JANUARY 6, 2023

The ACH system has proven to be scalable, secure, ubiquitous and reliable, but complaints about processing times persist, writes Sila CEO Shamir Karkal.

Payments Dive

APRIL 24, 2023

Card, ACH and check payment values climbed from 2018 to 2021, as cash was left behind, according to the Federal Reserve’s noncash payments study.

NACHA

APRIL 22, 2024

Same Day ACH and B2B Propel ACH Network Growth in the First Quarter mkahn@nacha.org Tue, 04/23/2024 - 01:01 Image Media ACH Network Logo with background

NACHA

FEBRUARY 13, 2024

ACH Network Records Strong Growth in 2023 as Same Day ACH Surpasses 3 Billion Payments Since Inception mkahn@nacha.org Wed, 02/14/2024 - 01:01 Image Media ACH Network Logo with background

PYMNTS

OCTOBER 4, 2020

Nonprofit Nacha , which enables Automated Clearing House ( ACH ) payments, has adopted eight new amendments to the Nacha Operating Rules that a press release said will help to modernize the payment style. The amendments concern Same Day ACH and new ways of making ACH payments easier to use, the release stated.

Payments Source

SEPTEMBER 16, 2020

Iowa-based fintech Dwolla, which spent most of the last decade touting various alternative ACH-powered faster payments approaches, is adding the more mainstream option of debit push payments in its latest iteration.

Stax

NOVEMBER 13, 2024

Understanding ACH credit payments means understanding the way in which different types of ACH payments are processed in the US banking system. ACH credit payments differ from ACH debit payments and both are distinct from credit and debit card payments. Learn More What are ACH Credit Payments?

Payment Savvy

MAY 16, 2023

The backbone of these developments is none other than America’s Automated Clearing House (ACH) which facilitates seamless electronic transactions between banks and financial institutions within its network. Instant ACH transfers have gained prominence as they cater to the increasing demand for expedited financial transactions.

NACHA

JULY 17, 2024

HERNDON, Virginia, July 18, 2024 – Same Day ACH reached new heights of payment volume and value as the modern ACH Network posted significant volume and value increases in the second quarter of 2024, Nacha reported. billion ACH payments in the second quarter, an increase of 6.3% The dollar value of these ACH payments totaled $21.6

Stax

JANUARY 17, 2024

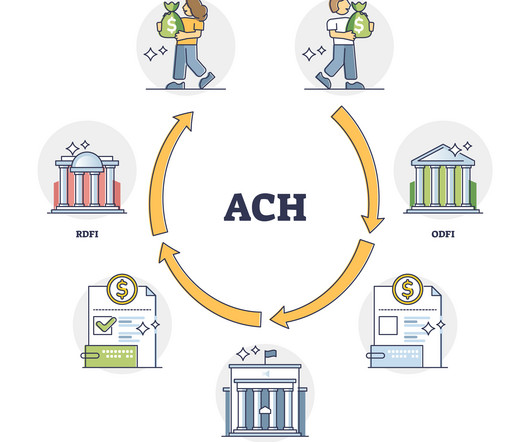

Automated Clearing House (ACH) payments are a type of electronic bank-to-bank payment system in the US. Unlike payments facilitated by card networks like Visa or Mastercard, ACH payments are managed by a body called the National Automated Clearing House Association (NACHA). Let’s get started.

Stax

SEPTEMBER 17, 2024

And on that note, two of the most common modes of electronic funds transfer are ACH and wire transfers. In this post, we’re going to review ACH and wire transfers, look at their similarities, and then see how they compare against each other. A typical ACH transaction is like a machine with multiple moving cogs.

Paystand

AUGUST 1, 2024

Table of Contents What is Considered an ACH Payment? What is the Difference Between ACH and EFT in Banking? What is the EFT Payment Method? Why Embrace Digital Payment Methods? The Future of Digital Payments

Stax

NOVEMBER 11, 2024

ACH transfers, or payments made through the Automated Clearing House network, account for billions of dollars in payments annually. In fact, NACHA, the nonprofit that governs the ACH payments network reported 6.1% The average consumer commonly uses the ACH network for automated bill payments and larger transactions. in Q4 2021.

Payment Savvy

NOVEMBER 8, 2022

Two of the more common methods are known as ACH and EFT transfers. Time for a deep dive, but first, let’s have a basic, simple-terms introduction to the two services before looking closer at ACH vs. EFT payments and transfers. What Exactly is an ACH? Depending on your end goal, there are a few different types of ACH.

Stax

APRIL 23, 2024

ACH payments are a convenient way for business owners, individuals, and employers to use intuitive automated banking throughout their daily lives. Most small business owners and employers are turning to ACH payments instead paper check payments because of the ease and instant access the ACH network provides.

National Processing

AUGUST 21, 2023

Learn more about what ACH payments are, the benefits for small businesses, and how you can start accepting ACH payments from your customers. The post How ACH Payments Impact Small Business Growth appeared first on National Processing.

Agile Payments

AUGUST 29, 2023

ACH API’s enable businesses or SaaS platforms that deal with larger transaction volumes to develop software that streamlines payments via the ACH network

National Processing

JULY 26, 2024

National Processing Check 21 vs ACH: Key Differences and Which One Fits Your Business A merchant or business trying to decide the best electronic payment processing system may be interested in the differences between Check 21 and ACH.

NACHA

NOVEMBER 19, 2024

Nacha Welcomes Stripe as a Preferred Partner for ACH Experience mkahn@nacha.org Wed, 11/20/2024 - 01:01 Image Media Preferred Partner logo with Background

Payments Dive

FEBRUARY 23, 2023

Last year’s same-day ACH limit increase helped nearly double that category’s total payment compared to 2021, Nacha said.

NACHA

OCTOBER 16, 2024

17, 2024 – Same Day ACH volume soared 67.5% in the third quarter of 2024, and total ACH Network payment volume rose 7.4% million Same Day ACH payments in the third quarter; the value of those payments rose 38.8% These results are continued proof of the robust adoption of Same Day ACH. RESTON, Virginia, Oct.

Stax

JUNE 27, 2024

If you’ve been accepting and using electronic payments in your business, you’ve probably come across two of the most popular terms in the digital payments scene— automated clearing house (ACH) and wire transfer. Global ACH is available but only for bank-to-bank networks Wire transfers have no geographic limitations.

Payments Dive

FEBRUARY 15, 2024

increase in payments volume for the ACH Network last year over 2022. Peer-to-peer transactions also contributed to a 4.8%

Payments Dive

DECEMBER 16, 2022

The upgrade adds the ability to pay for fuel at the pump, and using ACH allows the convenience store chain to save on swipe fees.

Bank Automation

AUGUST 30, 2024

Mastercard […] The post How Mastercard taps AI, open banking to predict ACH payment success appeared first on Bank Automation News. “We are very cautious and safe in the way we use AI” throughout the institution,” Jess Turner, head of global open banking and API at Mastercard, said Aug. 28 at Fintech South 2024 in Atlanta.

Fraud.net

OCTOBER 24, 2024

Gain insight into the most common ways ACH fraud can occur and impact your internal operations and stakeholder relationships.

NACHA

MARCH 19, 2024

HERNDON, Virginia, March 20, 2024 – Nacha’s Top 50 ranking of financial institution originators and receivers of ACH payments for 2023 was released today. The Top 50 originating institutions had total ACH Network volume of nearly 27.7 of the ACH Network’s total commercial payments volume. They accounted for 93.1%

Agile Payments

AUGUST 23, 2023

The Benefits of Employing an IVR Payment System using ACH and Credit Card Processing

Agile Payments

AUGUST 15, 2023

Understanding ACH Payment Processing and the Importance of Using a Checking Account Verification Tool

NACHA

AUGUST 8, 2024

8, 2024 – Today, Nacha announced Stronghold as a Preferred Partner for ACH Experience and ISO 20022. Stronghold joins a select group of innovators that Nacha recognizes for offering products and services that align with Nacha's core strategies to advance the ACH Network. RESTON, Virginia, Aug.

Payments Dive

MAY 6, 2022

That's opened the door for young companies that are using the ACH network to facilitate cannabis payments in states where it’s been legalized. In the cannabis business, federal illegality has kept many banks and payments companies on the sidelines.

EBizCharge

SEPTEMBER 17, 2024

An Automated Clearing House (ACH) transfer limit is the maximum amount of money that can be spent or received through the ACH network in a single transaction or within a specified period. This article will shed light on what ACH transactions are, the nature of their limits, and the influencing factors. What is an ACH transfer?

Finextra

FEBRUARY 15, 2024

Led by strong growth in Same Day ACH and business-to-business (B2B) payments, the ACH Network securely handled 31.5 billion payments valued at $80.1 trillion in 2023.

The Nilson Report

DECEMBER 5, 2024

The post Bectran Partners with GIACT for ACH Fraud Prevention appeared first on Nilson Report.

The Nilson Report

JULY 9, 2024

The post Gettrx Offers ACH Transactions appeared first on Nilson Report.

NACHA

MARCH 17, 2024

The new rules establish a base-level of ACH payment monitoring on all parties in the ACH Network (except consumers). While the new rules do not shift the liability for ACH payments, for the first time receiving financial institutions (RDFIs) will have a defined role in monitoring the ACH payments they receive.

The Nilson Report

DECEMBER 12, 2024

The post Nacha Welcomes Stripe as a Preferred Partner for ACH Experience appeared first on Nilson Report.

Payment Savvy

SEPTEMBER 5, 2024

You’ve probably heard the term “ACH deposit,” but what does it really mean? ACH stands for Automated Clearing House, a network that handles electronic payments and transfers. So, what is an ACH deposit? ACH direct deposits are common. What Is an ACH Deposit? So, what does an ACH deposit mean?

Payments Dive

MARCH 19, 2024

Automated payments volume processed by The Clearing House grew at a faster rate than at the Federal Reserve last year.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content