Instant ACH Transfers Online

Payment Savvy

MAY 16, 2023

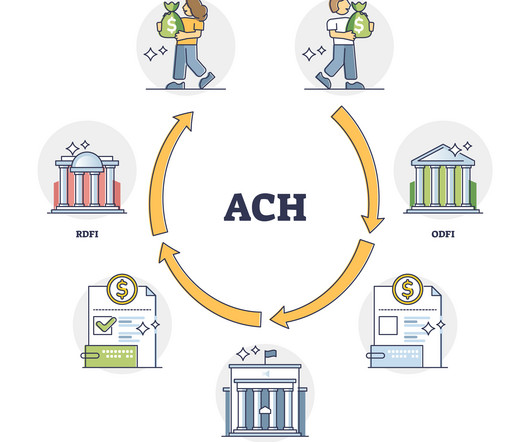

They ensure that all participants of this network follow certain guidelines to maintain its safety, security, and efficiency. Types of ACH Transfers Direct Deposit Direct deposits are electronic transfers of funds from governments or businesses directly into a recipient’s bank account.

Let's personalize your content