ACH Payment vs Wire Transfer Similarities and Differences: How to Choose Between ACH vs Wire

Stax

SEPTEMBER 17, 2024

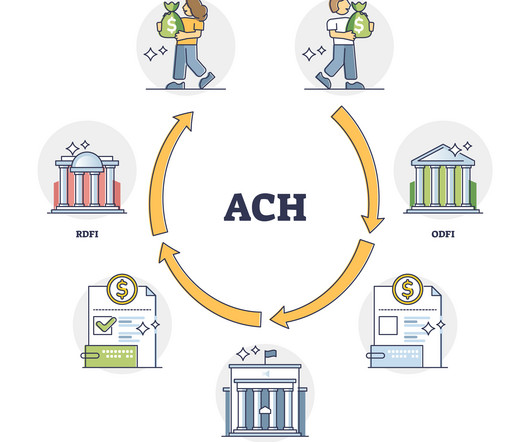

When did you last use cash or check to pay for something? And on that note, two of the most common modes of electronic funds transfer are ACH and wire transfers. In this post, we’re going to review ACH and wire transfers, look at their similarities, and then see how they compare against each other.

Let's personalize your content