Same Day ACH and B2B Propel ACH Network Growth in the First Quarter

NACHA

APRIL 22, 2024

Same Day ACH and B2B Propel ACH Network Growth in the First Quarter mkahn@nacha.org Tue, 04/23/2024 - 01:01 Image Media ACH Network Logo with background

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

NACHA

APRIL 22, 2024

Same Day ACH and B2B Propel ACH Network Growth in the First Quarter mkahn@nacha.org Tue, 04/23/2024 - 01:01 Image Media ACH Network Logo with background

NACHA

JULY 17, 2024

HERNDON, Virginia, July 18, 2024 – Same Day ACH reached new heights of payment volume and value as the modern ACH Network posted significant volume and value increases in the second quarter of 2024, Nacha reported. billion ACH payments in the second quarter, an increase of 6.3% There were 8.3

NACHA

FEBRUARY 13, 2024

ACH Network Records Strong Growth in 2023 as Same Day ACH Surpasses 3 Billion Payments Since Inception mkahn@nacha.org Wed, 02/14/2024 - 01:01 Image Media ACH Network Logo with background

NACHA

OCTOBER 16, 2024

17, 2024 – Same Day ACH volume soared 67.5% in the third quarter of 2024, and total ACH Network payment volume rose 7.4% million Same Day ACH payments in the third quarter; the value of those payments rose 38.8% These results are continued proof of the robust adoption of Same Day ACH.

NACHA

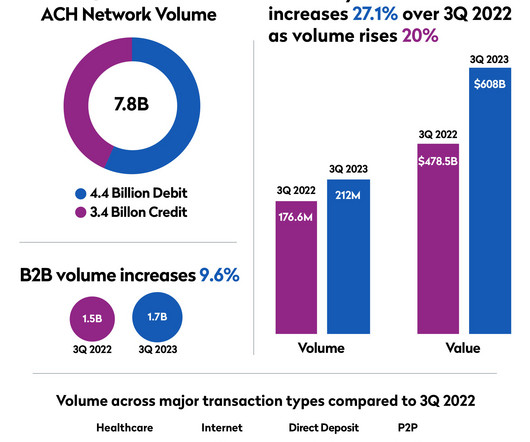

OCTOBER 16, 2023

Same Day ACH Growth Helps Lead ACH Network to Solid Third Quarter Results mkahn@nacha.org Tue, 10/17/2023 - 01:01 Image Media ACH Network Logo with background

Finextra

FEBRUARY 15, 2024

Led by strong growth in Same Day ACH and business-to-business (B2B) payments, the ACH Network securely handled 31.5 billion payments valued at $80.1 trillion in 2023.

The Nilson Report

FEBRUARY 15, 2024

The post ACH Network Records Strong Growth in 2023 as Same Day ACH Surpasses 3 Billion Payments appeared first on Nilson Report.

NACHA

JULY 24, 2023

Same Day ACH Transfers $1.2 Trillion in First Half of 2023 Helping Power the Modern ACH Network mkahn@nacha.org Tue, 07/25/2023 - 01:01 Image Media ACH Network Logo with background

PYMNTS

SEPTEMBER 17, 2018

NACHA — The Electronic Payments Association — announced that its membership has approved three new rules that will expand Same-Day ACH for all financial institutions and their customers. Funds from Same-Day ACH credits processed in the existing first window will be made available by 1:30 p.m. local time.

The Paypers

AUGUST 5, 2022

US-based National Automated Clearing House Association (Nacha) has revealed growth in Same Day ACH and B2B payments, moving 7.5 billion payments in Q2 of 2022.

PYMNTS

MAY 3, 2020

Payment solutions company GreenBox POS has announced a new Same Day ACH program to help businesses manage point of sale (POS) to business payments faster than usual, according to a press release. Usually, an ACH payment issued before the day’s 6 p.m. cutoff time takes until the next day to go through.

Payments Source

MARCH 15, 2019

Nacha's request to the Fed to extend submission times for its Same-Day ACH network was far from routine for two organizations that had worked together for decades.

PYMNTS

MARCH 13, 2019

NACHA, national administrator of the ACH network, said a third processing window for same-day transactions will be postponed for six months until the Federal Reserve Board of Governors (Fed Board) approves the initiative. In the latest example, PayPal Holdings Inc. and The Clearing House as partners.”.

PYMNTS

OCTOBER 10, 2016

NACHA’s launch of Same Day ACH ushered in three settlement windows, enabling ACH payments to be received same day. With Same Day ACH now in play, Throckmorton said the focus will be on creating additional efficiencies now that money is being moved faster. via all banks and credit unions.

PYMNTS

JANUARY 26, 2017

The Electronic Payments Association (NACHA), steward and rule maker of the ACH Network, recently provided the Same Day ACH transaction volume data for September 23 to December 30, 2016. Direct deposit made up the largest segment of Same Day ACH transaction volume — some 52 percent, or 6.8

PYMNTS

FEBRUARY 19, 2019

NACHA, the steward of the ACH Network, announced Tuesday (Feb. 19) that last year was a milestone year for the ACH Network with payment volume climbing to close to 1.5 In a press release , NACHA said it is the fourth year in a row that the ACH Network added more than 1 billion new payments. billion payments.

PYMNTS

NOVEMBER 16, 2016

And pay the very same day. NACHA, the payments association behind the ACH Network, said Tuesday (Nov. million Same Day ACH transactions occurred in October, the first full month after the initial Sept. The total value of those same-day payments came to $4.9 15) that 3.8

PYMNTS

JANUARY 25, 2017

The Electronic Payments Association (NACHA), steward and rule maker of the ACH Network, just released findings from the Same Day ACH transaction volume data for Sept. Same Day ACH is an industry initiative toward faster payments. Direct Deposit comprised 52 percent of Same Day ACH volume, or 6.8

PYMNTS

SEPTEMBER 7, 2017

Hollywood metaphor (almost) aside, there’s another industry near and dear to the Faster Payments Tracker ’s heart, and it’s also producing sequels these days. payment system has embarked on the financial equivalent of a film trilogy with its Same Day ACH initiative, an initiative which will bring big changes to the ACH Network.

PYMNTS

JUNE 6, 2017

NACHA, with its Same Day ACH offering, is leading the charge for faster payments in the U.S., We’ll give a daily double for the first data point, as it’s number of ACH transactions, and the second is quoted in terms of dollars over the whole calendar year of 2016. How fast is fast enough? Data Point Two: 26 Million.

PYMNTS

APRIL 17, 2017

According to the data, the number of ACH transactions in 2016 topped 25.6 2016 marked a significant year for the continued evolution and growth of the ACH Network,” said NACHA President and CEO Janet O. And it is this versatility that makes ACH payments a valued payment type and supports the continued growth of the ACH network.

PYMNTS

FEBRUARY 7, 2017

NACHA wants to quell any anxieties about the rollout of Same Day ACH, and the latest data from the payments group should breathe new confidence in banks that have adopted the technology. The association released the latest data on the rollout of Same Day ACH thus far with a new report today (Feb.

PYMNTS

APRIL 11, 2018

New data shows that the ACH Network processed 21.5 It is the third year in a row in which the number of new ACH transactions increased by more than one billion. And the network’s growth rate for last year is the highest since 2008. And the network’s growth rate for last year is the highest since 2008.

PYMNTS

NOVEMBER 2, 2018

The ACH network is thriving,” said Jane Larimer, chief operating officer of NACHA, in the press release. “Governments, financial institutions, businesses and consumers are all reaping the benefits the ACH network provides.”. billion ACH debit and close to 2.3 billion ACH debit and close to 2.4

PYMNTS

AUGUST 4, 2016

Phase One of Same Day ACH will officially launch in the U.S. It was then that NACHA proposed the shift to settling three times a day, ve days per week, to give consumers and businesses access to more efficient transactions. 23 to go smoothly is that the ACH network is already being used by banks and consumers.

PYMNTS

SEPTEMBER 9, 2016

With the Same Day ACH rollout coming in just two weeks and other faster payments initiatives taking off, financial institutions are taking significant steps to ensure the transition to a faster processing environment, including improving their payment security platforms to keep fraudsters at bay. Impact On Same Day ACH Rollout.

PYMNTS

AUGUST 3, 2016

Same Day ACH has been a focus for banks since it was proposed in early 2014. will be able to accept Same Day payments, with the option to originate them. 23 to go smoothly is that the ACH network is already being used by banks and consumers. Now, it’s coming to life.

Nanonets

MARCH 20, 2023

ACH (Automated Clearing House) payments are electronic fund transfers that use the ACH network to move funds between bank accounts in the United States. The ACH network is managed by NACHA, which was earlier known as the National Automated Clearing House Association.

PYMNTS

SEPTEMBER 14, 2018

ACH Network volume surpassed 2 billion transactions in August, an increase of more than 10 percent compared to the previous year. The ACH Network is thriving, and has achieved a milestone of more than 2 billion payments in one month,” said Jane Larimer, chief operating officer of NACHA. In addition, close to 1.5

PYMNTS

SEPTEMBER 21, 2016

In just a matter of days, the payments industry will see a significant — and ubiquitous — change in the way payments are sent and received. Same Day ACH will create a new option for faster payments for all the banks and credit unions across the U.S. Both are about moving payments faster than they are today.”.

PYMNTS

JANUARY 28, 2020

While RTP emerged as a new payment rail to address payment friction, NACHA, which manages the ACH payment rail, announced that its newest service on the legacy payment network, Same Day ACH, is helping to accelerate adoption of the rail. Same Day ACH spiked an impressive 39 percent during Q4, hitting 71.3

PYMNTS

JANUARY 29, 2019

During the fourth quarter of 2018, ACH Network volume saw more growth than it has in the last decade, according to the National Automated Clearing House Association (NACHA), which noted same-day ACH payments also reached a new level. billion ACH payments happened in Q4 last year, including 3.5 Upwards of 5.9

PYMNTS

NOVEMBER 5, 2018

According to the firm, B2B transactions were a key driver of ACH transaction growth in the third quarter of the year, leading NACHA Chief Operating Officer Jane Larimer to describe the ACH Network as “thriving.”. More people than ever are benefitting from Same Day ACH. billion ACH debit and nearly 2.3

Stax

APRIL 23, 2024

ACH payments are a convenient way for business owners, individuals, and employers to use intuitive automated banking throughout their daily lives. Most small business owners and employers are turning to ACH payments instead paper check payments because of the ease and instant access the ACH network provides.

EBizCharge

SEPTEMBER 18, 2024

What are ACH payments? ACH payments refer to electronic funds transfers (EFTs) between financial institutions using the ACH network. This system allows businesses and consumers to move money between bank accounts, either within the same institution or across different financial institutions.

EBizCharge

SEPTEMBER 17, 2024

An Automated Clearing House (ACH) transfer limit is the maximum amount of money that can be spent or received through the ACH network in a single transaction or within a specified period. That said, ACH transfers do come with some limitations. What is an ACH transfer limit?

PYMNTS

MAY 10, 2019

13, 2018, NACHA , the rules and standards body for the ACH network, announced that its voting members had approved amendments to the NACHA Operating Rules & Guidelines to establish a third Same Day ACH processing and settlement window,” the Federal Reserve wrote in the announcement. “On Sept.

PYMNTS

OCTOBER 4, 2020

Nonprofit Nacha , which enables Automated Clearing House ( ACH ) payments, has adopted eight new amendments to the Nacha Operating Rules that a press release said will help to modernize the payment style. The amendments concern Same Day ACH and new ways of making ACH payments easier to use, the release stated.

PYMNTS

SEPTEMBER 23, 2016

23) marks the launch of Same Day ACH, with three settlement windows enabling consumers and businesses to receive credit, same day, for payments made to them. is now capable of receiving and enabling this same-day capability. But in many ways, today’s milestone is all about what’s next for ACH.

Nanonets

APRIL 13, 2023

In this article, we'll explore the ACH network and ACH payments, how ACH payments function, and the ways in which it impacts our daily financial transactions. What are ACH payments? A few years ago, NACHA held a vote to upgrade ACH and make same-day ACH the default method of payment.

PYMNTS

JANUARY 18, 2018

According to a NACHA survey, 82 percent of financial institutions surveyed anticipate that Same Day ACH debit volume will grow at a rapid or steady rate. The survey was conducted in November and December of 2017 and included 22 financial institutions (FIs) that represent 78 percent of the ACH Network origination volume.

PYMNTS

MARCH 19, 2019

Data: March 19, 2012: Expected rollout date for a third Same-Day ACH (SDA) processing window. percent: Q4 increase in B2B transactions via the ACH network. Federal Reserve have a hidden agenda? 30 years: Age of the world wide web. million: SDA transaction volume in Q4 2018.

PYMNTS

SEPTEMBER 2, 2016

Not only are Same Day ACH payments on the way, but they are expected to have huge impacts on the way payments are made throughout the payments landscape. As we learned in last week’s installment of the Countdown to Same Day ACH podcast series, the first phase of the Same Day ACH initiative launches on Sept.

PYMNTS

FEBRUARY 11, 2020

The latest data from Nacha found a new record-high growth rate for adoption of ACH payments , with B2B payments showcasing a surge in adoption of the legacy payment rail that has recently turned to technologies that can augment the service, from the movement of transaction data with an ACH payment to the deployment of Same Day ACH.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content