What is an ACH Deposit and How Does It Work?

Stax

APRIL 23, 2024

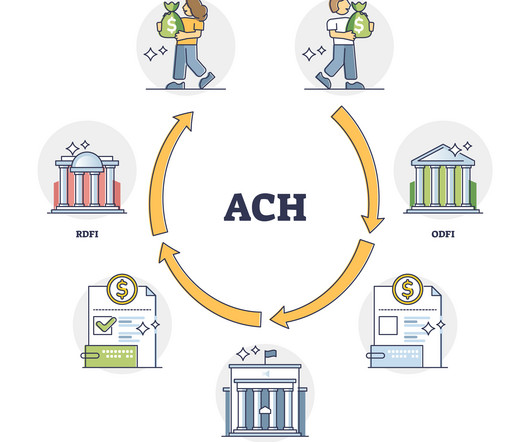

ACH payments are a convenient way for business owners, individuals, and employers to use intuitive automated banking throughout their daily lives. Most small business owners and employers are turning to ACH payments instead paper check payments because of the ease and instant access the ACH network provides.

Let's personalize your content