Mode Eleven partners with Finzly

The Paypers

MAY 21, 2023

Mode Eleven has announced its partnership with US-based fintech Finzly in order to implement its solutions for ACH operations and wire processing.

The Paypers

MAY 21, 2023

Mode Eleven has announced its partnership with US-based fintech Finzly in order to implement its solutions for ACH operations and wire processing.

Stax

NOVEMBER 13, 2024

With ACH debit, banks and lenders can automatically withdraw payments on the agreed-upon due date, ensuring timely repayment and a predictable payment stream. Insurance companies are often ACH operators, using ACH debit payments, making it easier for policyholders to maintain coverage without worrying about late payments.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Stax

APRIL 23, 2024

Many small businesses choose ACH operators because they are more convenient than most direct deposits. ACH transfers don’t come with high fees and transactions and they’re easily edited if an employer wants to adjust payroll, extend bonuses, or reimburse an employee.

PYMNTS

MARCH 6, 2019

By bringing Nvoicepay into the fold, FLEETCOR can expand its supplier acceptance and onboarding services to a range of payment tools, including ACH. However, it doesn’t address one of the most significant barriers to commercial card adoption: supplier acceptance.

Payment Savvy

SEPTEMBER 5, 2024

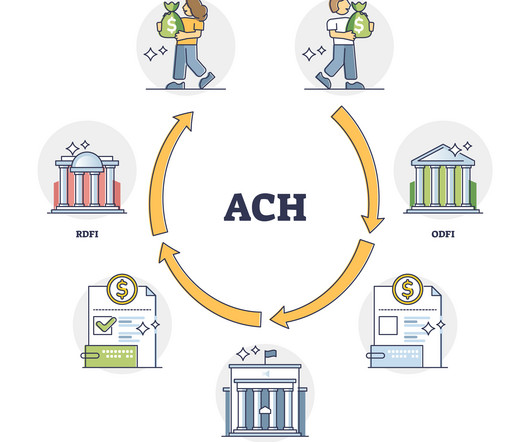

They give their bank a request to send funds through the ACH network. The bank then packages this request into a digital file, which gets sent to an ACH operator. This operator acts like a middleman, making sure everything is in order and routing the payment to the right place.

PYMNTS

AUGUST 12, 2019

Direct deposit over the ACH network eliminated that friction and got them earlier access to those funds. Fast-forward four decades, and everyone – FIs, ACH operators, FinTechs – have been working overtime to get payroll off the paper check and to get wages into workers’ bank accounts faster.

PYMNTS

MARCH 18, 2019

Last week, NACHA issued an ACH operations bulletin announcing the delay of the rollout of a third Same Day ACH (SDA) processing window by six months, to March 19, 2021. That all of this might stem from the hidden agenda of making it free – or as close to free as possible – to move money. A Couple of Important Dots.

Let's personalize your content