Mode Eleven partners with Finzly

The Paypers

MAY 21, 2023

Mode Eleven has announced its partnership with US-based fintech Finzly in order to implement its solutions for ACH operations and wire processing.

The Paypers

MAY 21, 2023

Mode Eleven has announced its partnership with US-based fintech Finzly in order to implement its solutions for ACH operations and wire processing.

Stax

APRIL 23, 2024

Many small businesses choose ACH operators because they are more convenient than most direct deposits. ACH transfers don’t come with high fees and transactions and they’re easily edited if an employer wants to adjust payroll, extend bonuses, or reimburse an employee. Q: What’s the difference between ACH and direct deposit?

Payment Savvy

SEPTEMBER 5, 2024

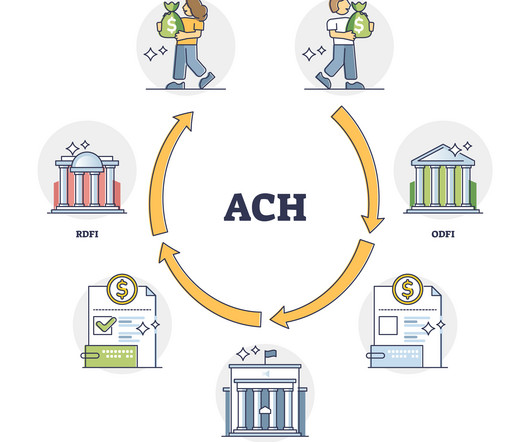

They give their bank a request to send funds through the ACH network. The bank then packages this request into a digital file, which gets sent to an ACH operator. This operator acts like a middleman, making sure everything is in order and routing the payment to the right place. One of the main advantages is cost.

Stax

NOVEMBER 13, 2024

It’s like a direct deposit from one account to another, but unlike wire transfers, they are not subject to a fee by the processing banks. Many businesses prefer ACH credit payments for paying suppliers or vendors, especially when the amounts vary or when the payments are made irregularly. Health insurance and premiums.

Payment Savvy

NOVEMBER 10, 2022

First of all, ACH payments are a lot cheaper than, for example, wire transfers. One wire transfer can cost you even up to $25 to send – and that’s only within the United States. International wire transfers increase the costs even more. An ACH payment, on the other hand, costs less than a dollar to process.

Nanonets

MARCH 30, 2023

This includes approving payments, sending them through different payment methods such as ACH transfers, checks, wires, and virtual card payments. The payment process using ACH transfers involves the payee creating a payment order which is received by the originator bank. Reconciling all transactions.

PYMNTS

MARCH 18, 2019

Last week, NACHA issued an ACH operations bulletin announcing the delay of the rollout of a third Same Day ACH (SDA) processing window by six months, to March 19, 2021. Or that wire transfer revenues could be cannibalized as end users are incented to shift payments to RTP. A Couple of Important Dots.

Let's personalize your content