What is an ACH Deposit and How Does It Work?

Stax

APRIL 23, 2024

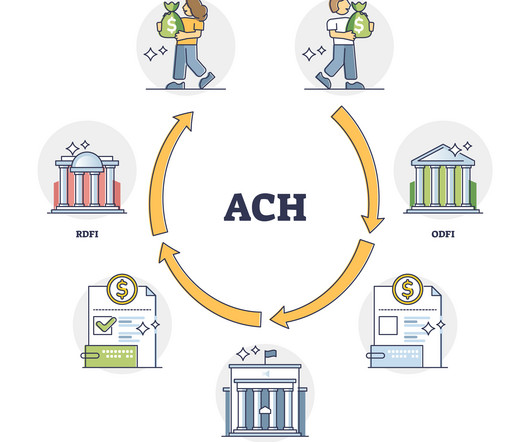

Most small business owners and employers are turning to ACH payments instead paper check payments because of the ease and instant access the ACH network provides. ACH transactions provide a quick and easy way to pay employees, submit and retrieve tax returns, and automatically control your finances within 1-2 business days.

Let's personalize your content