What is an ACH Deposit and How Does It Work?

Stax

APRIL 23, 2024

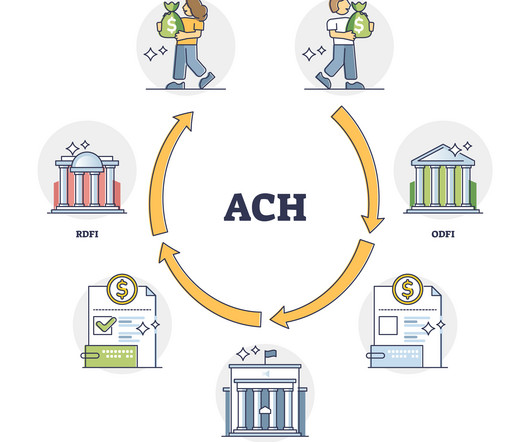

TL;DR Nearly 93% of Americans receive payments through direct deposit; Automated Clearing House makes it simpler for employers to manage funds without handing out physical checks or dealing with pesky extra fees. Many small businesses choose ACH operators because they are more convenient than most direct deposits.

Let's personalize your content