Instant ACH Transfers Online

Payment Savvy

MAY 16, 2023

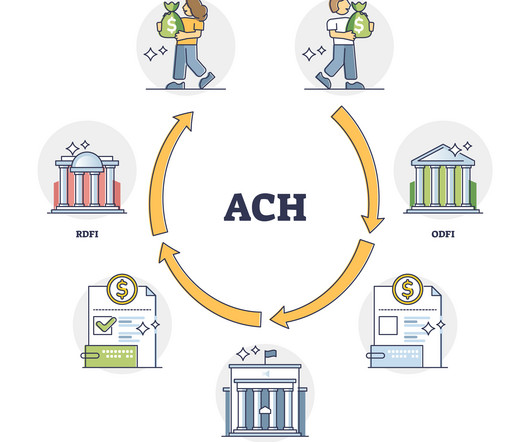

Types of ACH Transfers Direct Deposit Direct deposits are electronic transfers of funds from governments or businesses directly into a recipient’s bank account. By using direct deposits, recipients can access their funds quicker and more securely compared to traditional paper checks.

Let's personalize your content