ACH Payment vs Wire Transfer Similarities and Differences: How to Choose Between ACH vs Wire

Stax

SEPTEMBER 17, 2024

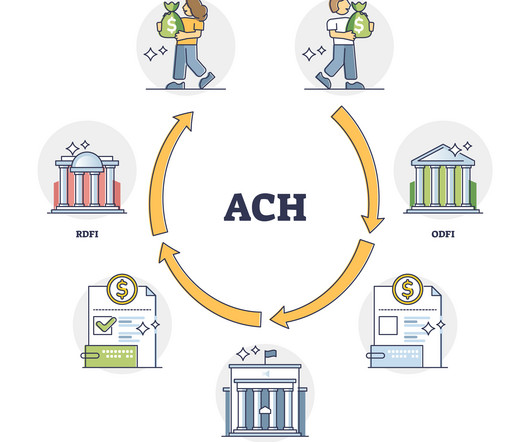

In this post, we’re going to review ACH and wire transfers, look at their similarities, and then see how they compare against each other. TL;DR ACH is cost-effective and ideal for recurring payments, with transfer times ranging from 1-3 business days. Cost ACH transfers triumph when it comes to transfer fees and costs.

Let's personalize your content