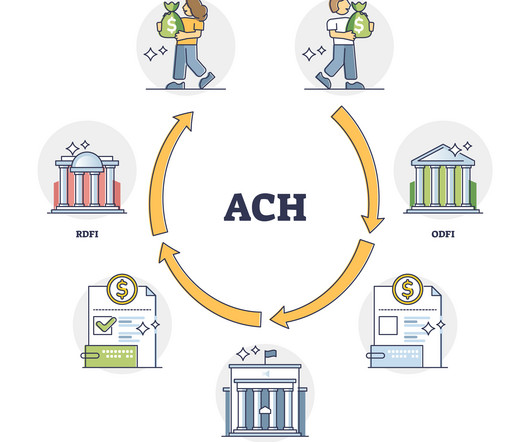

Instant ACH Transfers Online

Payment Savvy

MAY 16, 2023

Direct deposits enable entities like government agencies and businesses to deliver funds to the intended recipients efficiently, streamlining the payment process and reducing administrative costs. By using direct deposits, recipients can access their funds quicker and more securely compared to traditional paper checks.

Let's personalize your content