Same Day ACH and B2B Propel ACH Network Growth in the First Quarter

NACHA

APRIL 22, 2024

Same Day ACH and B2B Propel ACH Network Growth in the First Quarter mkahn@nacha.org Tue, 04/23/2024 - 01:01 Image Media ACH Network Logo with background

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

NACHA

APRIL 22, 2024

Same Day ACH and B2B Propel ACH Network Growth in the First Quarter mkahn@nacha.org Tue, 04/23/2024 - 01:01 Image Media ACH Network Logo with background

Stax

NOVEMBER 13, 2024

Understanding ACH credit payments means understanding the way in which different types of ACH payments are processed in the US banking system. ACH credit payments differ from ACH debit payments and both are distinct from credit and debit card payments. Learn More What are ACH Credit Payments?

NACHA

JULY 17, 2024

HERNDON, Virginia, July 18, 2024 – Same Day ACH reached new heights of payment volume and value as the modern ACH Network posted significant volume and value increases in the second quarter of 2024, Nacha reported. billion ACH payments in the second quarter, an increase of 6.3% There were 8.3 trillion, a 7% increase.

Stax

MARCH 27, 2025

Thats why 92% of consumers and 82% of companies reportedly made the switch to electronic payments, like Electronic Funds Transfers (EFT) and Automated Clearing House (ACH). EFT and ACH payments are fast, secure, and hassle-free. EFT and ACH offer more security and convenience than cash and checks, but they also come with limitations.

NACHA

FEBRUARY 13, 2024

ACH Network Records Strong Growth in 2023 as Same Day ACH Surpasses 3 Billion Payments Since Inception mkahn@nacha.org Wed, 02/14/2024 - 01:01 Image Media ACH Network Logo with background

Agile Payments

FEBRUARY 5, 2019

How can an ACH Transfer API help your business or SaaS? An ACH Transfer API provides an additional payment option: Using the ACH network allows a business to debit or credit checking and savings accounts.

PYMNTS

FEBRUARY 19, 2019

NACHA, the steward of the ACH Network, announced Tuesday (Feb. 19) that last year was a milestone year for the ACH Network with payment volume climbing to close to 1.5 In a press release , NACHA said it is the fourth year in a row that the ACH Network added more than 1 billion new payments. billion payments.

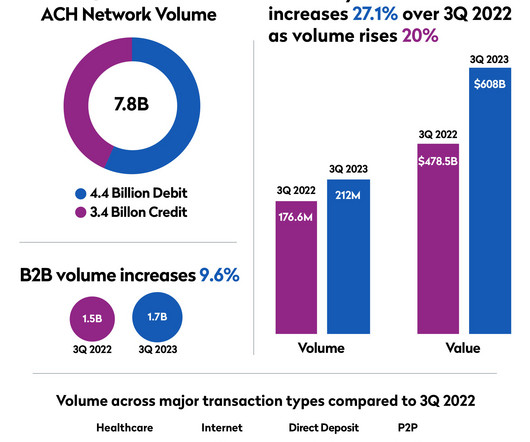

Fintech Finance

MARCH 31, 2025

Transaction volume on the EPN ® system, the ACH network operated by The Clearing House Payments Company L.L.C., in 2024, continuing the trend of yearly ACH volume and value growth. ACH commercial volume last year. ACH volume has been growing across all user types and use cases. .

Agile Payments

JANUARY 9, 2020

While the ACH network is still a batch network, utilizing an ACH Payment Gateway API can do wonders for software applications in enhancing their capabilities by communicating with a real-time communication integration. Let's examine some of the modern communication tools available from these ACH gateways.

Payments Dive

MAY 6, 2022

That's opened the door for young companies that are using the ACH network to facilitate cannabis payments in states where it’s been legalized. In the cannabis business, federal illegality has kept many banks and payments companies on the sidelines.

NACHA

AUGUST 8, 2024

8, 2024 – Today, Nacha announced Stronghold as a Preferred Partner for ACH Experience and ISO 20022. Stronghold joins a select group of innovators that Nacha recognizes for offering products and services that align with Nacha's core strategies to advance the ACH Network. RESTON, Virginia, Aug.

PYMNTS

NOVEMBER 2, 2018

1) that automated clearing house (ACH) payments totaled more than 5.6 The ACH network is thriving,” said Jane Larimer, chief operating officer of NACHA, in the press release. “Governments, financial institutions, businesses and consumers are all reaping the benefits the ACH network provides.”. “The

PYMNTS

OCTOBER 4, 2020

Nonprofit Nacha , which enables Automated Clearing House ( ACH ) payments, has adopted eight new amendments to the Nacha Operating Rules that a press release said will help to modernize the payment style. The amendments concern Same Day ACH and new ways of making ACH payments easier to use, the release stated.

Agile Payments

AUGUST 29, 2023

ACH API’s enable businesses or SaaS platforms that deal with larger transaction volumes to develop software that streamlines payments via the ACH network

Stax

APRIL 23, 2024

ACH payments are a convenient way for business owners, individuals, and employers to use intuitive automated banking throughout their daily lives. Most small business owners and employers are turning to ACH payments instead paper check payments because of the ease and instant access the ACH network provides.

PYMNTS

SEPTEMBER 17, 2018

NACHA — The Electronic Payments Association — announced that its membership has approved three new rules that will expand Same-Day ACH for all financial institutions and their customers. The expansion of Same-Day ACH will be made possible through the creation of a new Same-Day ACH processing window by the two ACH Network operators.

Agile Payments

JUNE 3, 2020

An ACH API integration enables a business or SaaS platform to automate ACH payment processing and reconciliation. Any business that accepts recurring payments should leverage the ACH network for 2 compelling reasons:

NACHA

OCTOBER 16, 2023

Same Day ACH Growth Helps Lead ACH Network to Solid Third Quarter Results mkahn@nacha.org Tue, 10/17/2023 - 01:01 Image Media ACH Network Logo with background

NACHA

OCTOBER 16, 2024

17, 2024 – Same Day ACH volume soared 67.5% in the third quarter of 2024, and total ACH Network payment volume rose 7.4% million Same Day ACH payments in the third quarter; the value of those payments rose 38.8% These results are continued proof of the robust adoption of Same Day ACH. RESTON, Virginia, Oct.

The Nilson Report

MARCH 12, 2024

The post Growing Volumes on The Clearing House’s ACH Network appeared first on Nilson Report.

Stax

NOVEMBER 11, 2024

ACH transfers, or payments made through the Automated Clearing House network, account for billions of dollars in payments annually. In fact, NACHA, the nonprofit that governs the ACH payments network reported 6.1% The average consumer commonly uses the ACH network for automated bill payments and larger transactions.

PYMNTS

APRIL 11, 2018

New data shows that the ACH Network processed 21.5 It is the third year in a row in which the number of new ACH transactions increased by more than one billion. And the network’s growth rate for last year is the highest since 2008. And the network’s growth rate for last year is the highest since 2008.

Payment Savvy

MAY 16, 2023

The backbone of these developments is none other than America’s Automated Clearing House (ACH) which facilitates seamless electronic transactions between banks and financial institutions within its network. Instant ACH transfers have gained prominence as they cater to the increasing demand for expedited financial transactions.

NACHA

JULY 24, 2023

Same Day ACH Transfers $1.2 Trillion in First Half of 2023 Helping Power the Modern ACH Network mkahn@nacha.org Tue, 07/25/2023 - 01:01 Image Media ACH Network Logo with background

Payments Dive

FEBRUARY 15, 2024

increase in payments volume for the ACH Network last year over 2022. Peer-to-peer transactions also contributed to a 4.8%

Stax

SEPTEMBER 17, 2024

And on that note, two of the most common modes of electronic funds transfer are ACH and wire transfers. In this post, we’re going to review ACH and wire transfers, look at their similarities, and then see how they compare against each other. A typical ACH transaction is like a machine with multiple moving cogs.

NACHA

MARCH 17, 2024

The new rules establish a base-level of ACH payment monitoring on all parties in the ACH Network (except consumers). While the new rules do not shift the liability for ACH payments, for the first time receiving financial institutions (RDFIs) will have a defined role in monitoring the ACH payments they receive.

Payments Source

AUGUST 12, 2020

ACH network steward Nacha says Visa has been added to its list of partners for a payment information exchange it is creating to help credentialed service providers share and manage electronic payments information for faster and more secure processing.

Payment Savvy

NOVEMBER 8, 2022

Two of the more common methods are known as ACH and EFT transfers. Time for a deep dive, but first, let’s have a basic, simple-terms introduction to the two services before looking closer at ACH vs. EFT payments and transfers. What Exactly is an ACH? Depending on your end goal, there are a few different types of ACH.

PYMNTS

OCTOBER 10, 2016

NACHA’s launch of Same Day ACH ushered in three settlement windows, enabling ACH payments to be received same day. NACHA offers an ISO 20022 Mapping Guide to businesses that enable them to send ISO formatted messages to financial institutions that can then move those payments and information through the ACH Network.

Fintech Finance

AUGUST 7, 2024

Nacha announced that Visa , a world leader in digital payments, has joined its Preferred Partner Program for ACH Experience, Open Banking and Account Validation. Once consumer-permissioned data is integrated, account and balance details can be instantly verified to facilitate faster ACH payment set-up and more seamless payment flows. “We

Fintech Finance

FEBRUARY 28, 2025

Nacha s newest Preferred Partner is ACI Worldwide , which joins as a Preferred Partner for ACH Experience/Fraud Monitoring/Risk and Fraud Prevention. Making the modern ACH Network even easier to use is a key priority at Nacha, said Jane Larimer, Nacha President and CEO.

NACHA

MARCH 19, 2024

HERNDON, Virginia, March 20, 2024 – Nacha’s Top 50 ranking of financial institution originators and receivers of ACH payments for 2023 was released today. The Top 50 originating institutions had total ACH Network volume of nearly 27.7 of the ACH Network’s total commercial payments volume. They accounted for 93.1%

Payments Source

MARCH 15, 2019

Nacha's request to the Fed to extend submission times for its Same-Day ACH network was far from routine for two organizations that had worked together for decades.

PYMNTS

APRIL 17, 2017

The Electronics Payment Association NACHA announced significant increases in the ACH Network transactions. billion | Amount of 2016 overall ACH monetary transactions. percent | Percentage increase of ACH transactions from 2015 to 2016. 52 percent | Percentage increase in number of ACH same-day direct deposits.

Stax

JANUARY 17, 2024

Automated Clearing House (ACH) payments are a type of electronic bank-to-bank payment system in the US. Unlike payments facilitated by card networks like Visa or Mastercard, ACH payments are managed by a body called the National Automated Clearing House Association (NACHA). Let’s get started.

PYMNTS

JANUARY 29, 2019

During the fourth quarter of 2018, ACH Network volume saw more growth than it has in the last decade, according to the National Automated Clearing House Association (NACHA), which noted same-day ACH payments also reached a new level. billion ACH payments happened in Q4 last year, including 3.5 Upwards of 5.9

PYMNTS

MARCH 13, 2019

NACHA, national administrator of the ACH network, said a third processing window for same-day transactions will be postponed for six months until the Federal Reserve Board of Governors (Fed Board) approves the initiative. In the latest example, PayPal Holdings Inc. and The Clearing House as partners.”.

The Nilson Report

FEBRUARY 15, 2024

The post ACH Network Records Strong Growth in 2023 as Same Day ACH Surpasses 3 Billion Payments appeared first on Nilson Report.

Payments Dive

FEBRUARY 12, 2020

In 2018 alone, ACH network volume reached nearly 23 billion payments –70 payments per person in the U.S. In the 12 months ending February 2019, payment volume across the ACH network increased 7.2%, reaching over 100 million ACH payments per banking day, a first for the ACH network.

PYMNTS

NOVEMBER 16, 2016

NACHA, the payments association behind the ACH Network, said Tuesday (Nov. million Same Day ACH transactions occurred in October, the first full month after the initial Sept. Two years ago, industry observers predicted that 60 percent of the Same Day ACH transactions would come from existing users. 15) that 3.8

EBizCharge

MAY 8, 2024

ACH fees may not seem like much, but they can make a big difference for even the most prominent businesses. While ACH transactions are everywhere these days, understanding these fees can still feel like navigating a maze. What is ACH? What are ACH processing fees? For instance, a company might be charged a $0.50

PYMNTS

MAY 3, 2020

Payment solutions company GreenBox POS has announced a new Same Day ACH program to help businesses manage point of sale (POS) to business payments faster than usual, according to a press release. Usually, an ACH payment issued before the day’s 6 p.m. Usually, an ACH payment issued before the day’s 6 p.m. Eastern Standard Time.

PYMNTS

SEPTEMBER 14, 2018

ACH Network volume surpassed 2 billion transactions in August, an increase of more than 10 percent compared to the previous year. The ACH Network is thriving, and has achieved a milestone of more than 2 billion payments in one month,” said Jane Larimer, chief operating officer of NACHA. In addition, close to 1.5

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content