GreenBox POS Enables Same Day ACH Deposits To Business Accounts

PYMNTS

MAY 3, 2020

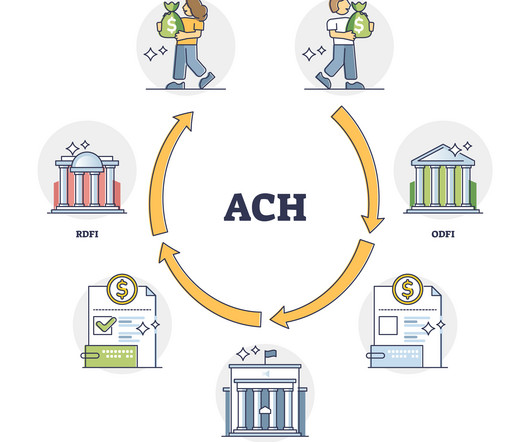

Payment solutions company GreenBox POS has announced a new Same Day ACH program to help businesses manage point of sale (POS) to business payments faster than usual, according to a press release. Usually, an ACH payment issued before the day’s 6 p.m. cutoff time takes until the next day to go through.

Let's personalize your content