B2B payments lift Same Day ACH, even as checks persist

Payments Source

OCTOBER 17, 2019

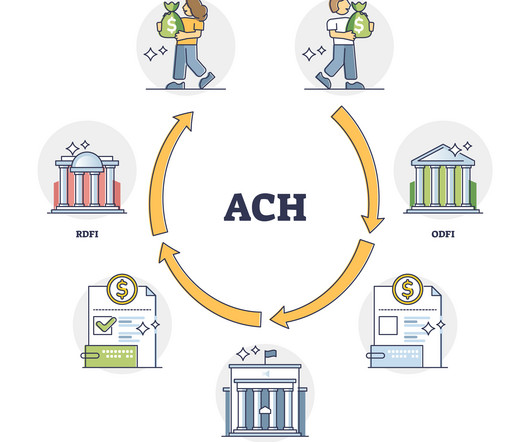

Eliminating checks from corporate payments will take many more years, but Nacha’s latest data suggests the B2B category is playing a key role in Same Day ACH's growth.

Let's personalize your content