How to make vendor payments using ACH

Nanonets

APRIL 18, 2023

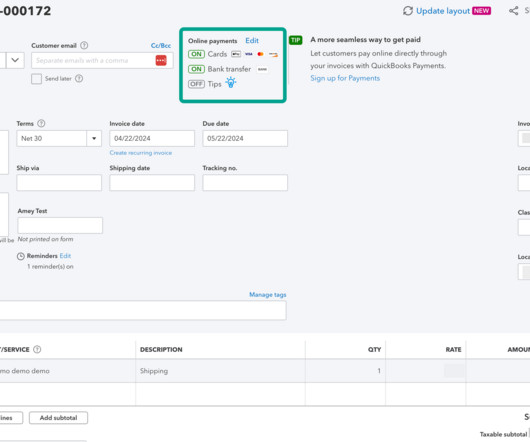

Automated Clearing House (ACH) payments have become increasingly popular among growing businesses, for their faster processing times, lower fees, and reduced risk of fraud. However, managing ACH payments can be a challenging task for AP teams, especially when dealing with multiple vendors and payment preferences.

Let's personalize your content