Data: Same-day ACH volume vs. fraud

Payments Source

SEPTEMBER 20, 2018

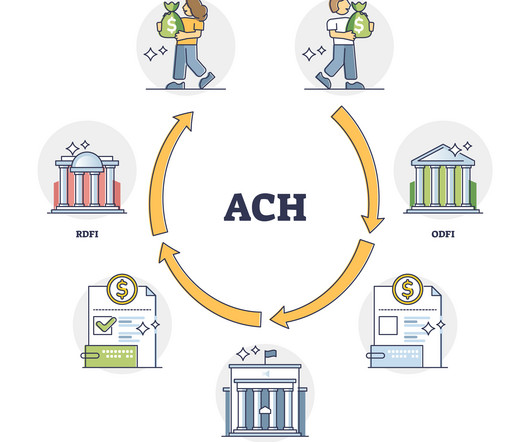

financial institutions have made same-day ACH funds available without seeing any major shifts in fraud. But observers warn that as same-day ACH introduces broader access and bigger transactions, it will become a bigger temptation for fraudsters. More than half of U.S.

Let's personalize your content