Same-day ACH payments soar

Payments Dive

APRIL 20, 2023

The dollar value of same-day ACH payments nearly doubled in the first quarter as the volume increased 20.7%, Nacha said this week in a quarterly update.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Dive

APRIL 20, 2023

The dollar value of same-day ACH payments nearly doubled in the first quarter as the volume increased 20.7%, Nacha said this week in a quarterly update.

NACHA

APRIL 22, 2024

Same Day ACH and B2B Propel ACH Network Growth in the First Quarter mkahn@nacha.org Tue, 04/23/2024 - 01:01 Image Media ACH Network Logo with background

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

NACHA

JULY 17, 2024

HERNDON, Virginia, July 18, 2024 – Same Day ACH reached new heights of payment volume and value as the modern ACH Network posted significant volume and value increases in the second quarter of 2024, Nacha reported. billion ACH payments in the second quarter, an increase of 6.3% over the same time period in 2023.

NACHA

FEBRUARY 13, 2024

ACH Network Records Strong Growth in 2023 as Same Day ACH Surpasses 3 Billion Payments Since Inception mkahn@nacha.org Wed, 02/14/2024 - 01:01 Image Media ACH Network Logo with background

Payments Source

SEPTEMBER 20, 2016

The tighter processing deadlines of same-day ACH mean that conventional fraud prevention measures will no longer be adequate or effective.

Stax

MARCH 27, 2025

Thats why 92% of consumers and 82% of companies reportedly made the switch to electronic payments, like Electronic Funds Transfers (EFT) and Automated Clearing House (ACH). EFT and ACH payments are fast, secure, and hassle-free. EFT and ACH offer more security and convenience than cash and checks, but they also come with limitations.

PYMNTS

SEPTEMBER 17, 2018

NACHA — The Electronic Payments Association — announced that its membership has approved three new rules that will expand Same-Day ACH for all financial institutions and their customers. Funds from Same-Day ACH credits processed in the existing first window will be made available by 1:30 p.m. local time.

NACHA

OCTOBER 16, 2024

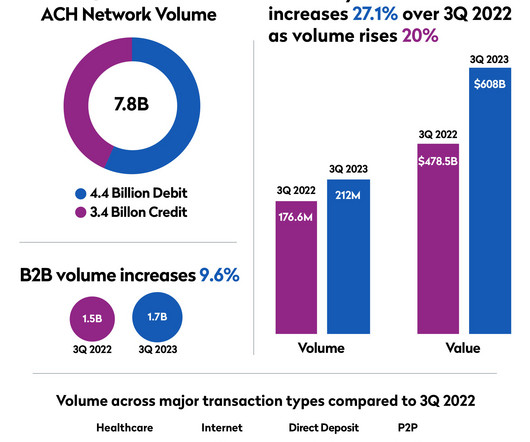

17, 2024 – Same Day ACH volume soared 67.5% in the third quarter of 2024, and total ACH Network payment volume rose 7.4% million Same Day ACH payments in the third quarter; the value of those payments rose 38.8% These results are continued proof of the robust adoption of Same Day ACH.

Payments Source

SEPTEMBER 20, 2018

financial institutions have made same-day ACH funds available without seeing any major shifts in fraud. But observers warn that as same-day ACH introduces broader access and bigger transactions, it will become a bigger temptation for fraudsters. More than half of U.S.

PYMNTS

OCTOBER 10, 2016

NACHA’s launch of Same Day ACH ushered in three settlement windows, enabling ACH payments to be received same day. With Same Day ACH now in play, Throckmorton said the focus will be on creating additional efficiencies now that money is being moved faster. via all banks and credit unions.

PYMNTS

SEPTEMBER 21, 2016

Same Day ACH is ready for its debut at the end of the week, and for some, its launch signals the next step for the payments industry to become faster and more digital. But a new report finds that, even as Same Day ACH is fast-approaching, businesses are actually increasing their use of paper checks.

PYMNTS

MARCH 13, 2019

NACHA, national administrator of the ACH network, said a third processing window for same-day transactions will be postponed for six months until the Federal Reserve Board of Governors (Fed Board) approves the initiative. In the latest example, PayPal Holdings Inc. and The Clearing House as partners.”.

PYMNTS

MAY 3, 2020

Payment solutions company GreenBox POS has announced a new Same Day ACH program to help businesses manage point of sale (POS) to business payments faster than usual, according to a press release. Usually, an ACH payment issued before the day’s 6 p.m. cutoff time takes until the next day to go through.

Payments Source

SEPTEMBER 23, 2016

Starting today, banks and credit unions will get two extra chances every 24 hours to handle Automated Clearing House (ACH) credit payments. But by itself, same-day speed may not be enough to meet the demands of an increasingly digital world.

PYMNTS

NOVEMBER 16, 2016

And pay the very same day. NACHA, the payments association behind the ACH Network, said Tuesday (Nov. million Same Day ACH transactions occurred in October, the first full month after the initial Sept. The total value of those same-day payments came to $4.9 If you build it, they will come.

PYMNTS

JANUARY 26, 2017

The Electronic Payments Association (NACHA), steward and rule maker of the ACH Network, recently provided the Same Day ACH transaction volume data for September 23 to December 30, 2016. Direct deposit made up the largest segment of Same Day ACH transaction volume — some 52 percent, or 6.8 million, $5.9

Payments Source

MARCH 15, 2019

Nacha's request to the Fed to extend submission times for its Same-Day ACH network was far from routine for two organizations that had worked together for decades.

PYMNTS

SEPTEMBER 15, 2017

In a recent interview with PYMNTS’ Karen Webster, Jane Larimer, chief operating officer at NACHA, said the financial services industry has done much preparation in terms of enhancing systems and processing, in tandem with significant testing, after a smooth Phase 1 of Same Day ACH debuted last September. 2016 and July 2017.

Payments Source

MARCH 13, 2019

After more than two years of successful operation in delivering Same-Day ACH payments, Nacha's request to add a third processing window has been denied by the Federal Reserve, which says it has to obtain public comment on the concept.

PYMNTS

NOVEMBER 15, 2016

The Electronic Payments Association, NACHA, has released volume data tied to the first calendar month of same-day ACH transactions. For the month, Same Day ACH was responsible for 3.8 The statistics show that Same Day ACH has been emerging as a “ubiquitous U.S. billion of value.

Payments Source

OCTOBER 17, 2019

Eliminating checks from corporate payments will take many more years, but Nacha’s latest data suggests the B2B category is playing a key role in Same Day ACH's growth.

PYMNTS

MARCH 23, 2017

Receivable Savvy, an accounts receivable and order-to-cash management firm, wants suppliers to see Same Day ACH as an opportunity to bolster cash flow. The company, which provides education and resources for suppliers, recently released a new eBook to guide vendors on how to take advantage of Same Day ACH technology.

Finextra

FEBRUARY 15, 2024

Led by strong growth in Same Day ACH and business-to-business (B2B) payments, the ACH Network securely handled 31.5 billion payments valued at $80.1 trillion in 2023.

Payments Dive

APRIL 8, 2016

In a NACHA survey, 95 percent of respondents indicated that they will offer their clients same-day ACH origination services by year-end.

Payments Source

OCTOBER 18, 2017

15 launch of same-day ACH debit payments, providing a snapshot of what Nacha expects will be a growing channel. The first round of data is in following the Sept.

Payments Source

MARCH 16, 2018

Nacha has completed the third and final phase of the faster payments launch, requiring banks and credit unions to make Same-Day ACH funds available to depositors by 5 p.m. in local time.

PYMNTS

AUGUST 31, 2017

September will be a big month for NACHA’s Same-Day ACH initiative. 15, NACHA will roll out phase two of its Same-Day ACH Rule, and small businesses stand to gain significantly from the effort, according to reports at Nav.com. It incorporates more payment scenarios into the Same-Day ACH initiative.

Payments Source

OCTOBER 20, 2016

The fact that the number of cybersecurity incidents affecting companies is rising at an alarming rate year over year hardly raises eyebrows anymore.

PYMNTS

OCTOBER 4, 2020

Nonprofit Nacha , which enables Automated Clearing House ( ACH ) payments, has adopted eight new amendments to the Nacha Operating Rules that a press release said will help to modernize the payment style. The amendments concern Same Day ACH and new ways of making ACH payments easier to use, the release stated.

Payments Dive

FEBRUARY 23, 2023

Last year’s same-day ACH limit increase helped nearly double that category’s total payment compared to 2021, Nacha said.

PYMNTS

SEPTEMBER 7, 2017

payment system has embarked on the financial equivalent of a film trilogy with its Same Day ACH initiative, an initiative which will bring big changes to the ACH Network. Those same organizations are now working to make sure the next stage unfolds smoothly as well. Y2K all over again.

Finovate

NOVEMBER 14, 2024

So far, the IPX solution has displaced 25% of same-day ACH transactions, with 53% fewer fraud losses compared to same-day ACH and an 83% reduction in operational overhead for P2P payment networks.” ” said Star One CEO Gary Rodrigues.

NACHA

OCTOBER 16, 2023

Same Day ACH Growth Helps Lead ACH Network to Solid Third Quarter Results mkahn@nacha.org Tue, 10/17/2023 - 01:01 Image Media ACH Network Logo with background

PYMNTS

JUNE 6, 2017

NACHA, with its Same Day ACH offering, is leading the charge for faster payments in the U.S., We’ll give a daily double for the first data point, as it’s number of ACH transactions, and the second is quoted in terms of dollars over the whole calendar year of 2016. When we look at same day, it is over half.

PYMNTS

FEBRUARY 7, 2017

NACHA wants to quell any anxieties about the rollout of Same Day ACH, and the latest data from the payments group should breathe new confidence in banks that have adopted the technology. The association released the latest data on the rollout of Same Day ACH thus far with a new report today (Feb.

PYMNTS

SEPTEMBER 15, 2017

In an interview with PYMNTS’ Karen Webster, Jane Larimer , chief operating officer at NACHA , said that the implementation of Phase 1 of Same Day ACH has gone smoothly, with a live debut last September. We’re seeing robust use of same-day ACH credits,” said Larimer.

PYMNTS

AUGUST 24, 2017

There’s much to look forward to as the September rollout of Phase 2 of Same Day ACH (Debit Pull) looms, but David Barnhardt, executive vice president of full-service payment and verification solutions provider GIACT , thinks there’s just as much reason for caution. “I Don’t Be Used by Use Cases.

PYMNTS

FEBRUARY 19, 2019

NACHA, the steward of the ACH Network, announced Tuesday (Feb. 19) that last year was a milestone year for the ACH Network with payment volume climbing to close to 1.5 In a press release , NACHA said it is the fourth year in a row that the ACH Network added more than 1 billion new payments. billion payments. million debits.

NACHA

JULY 24, 2023

Same Day ACH Transfers $1.2 Trillion in First Half of 2023 Helping Power the Modern ACH Network mkahn@nacha.org Tue, 07/25/2023 - 01:01 Image Media ACH Network Logo with background

Payment Savvy

MAY 16, 2023

The backbone of these developments is none other than America’s Automated Clearing House (ACH) which facilitates seamless electronic transactions between banks and financial institutions within its network. Instant ACH transfers have gained prominence as they cater to the increasing demand for expedited financial transactions.

PYMNTS

APRIL 5, 2019

Small business lending platform OnDeck is accelerating access to capital for its users through the launch of a same-day funding option. And with our Same-Day ACH service, we have demonstrated again our commitment to relentlessly innovating on behalf of small businesses to provide our customers with faster service.”

PYMNTS

MAY 7, 2018

With Same-Day ACH now a reality in the U.S., In its analysis of the Same-Day ACH rollout, NACHA found no evidence that it led to an increase in fraud attempts or successful breaches. That doesn’t mean that fraud linked to ACH transactions is nonexistent, however.

Payments Dive

OCTOBER 20, 2023

Businesses are increasingly turning to same-day ACH payments this year, according to Nacha, a national clearinghouse that manages electronic money movement.

PYMNTS

NOVEMBER 9, 2017

Fourteen months since the Phase 1 roll out, 43 percent of financial institutions (FIs) now allow businesses to originate same-day ACH credit. Zero FIs have reported an increase in fraud due to SDA products. For FIs, debit use cases are two times more likely to be important than credit use cases.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content