How Internal and External Monitoring Drive Regulatory Compliance: An Expert Interview

Neopay

JANUARY 2, 2024

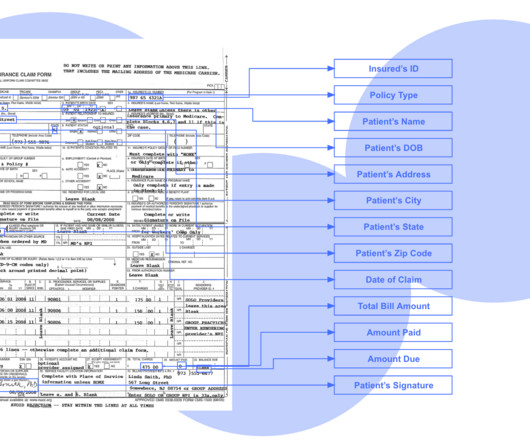

In an exclusive interview with Neopay’s Consultancy Manager, Margita Layne, we delve into the pivotal role of internal and external monitoring in ensuring regulatory compliance within the financial services sector. Additionally, Neopay tests various files to ensure that processes align with regulatory and internal requirements.

Let's personalize your content