Beyond Manual Processes: Embracing AP Automation

The Fintech Times

FEBRUARY 14, 2024

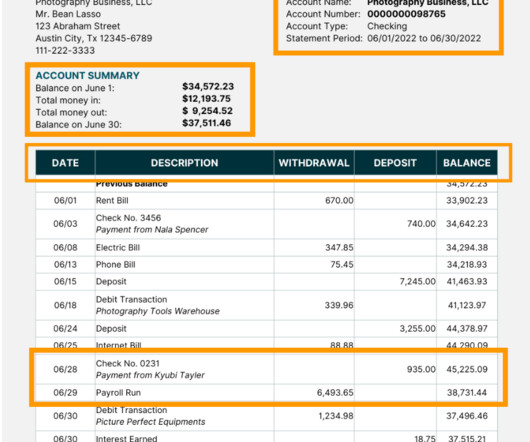

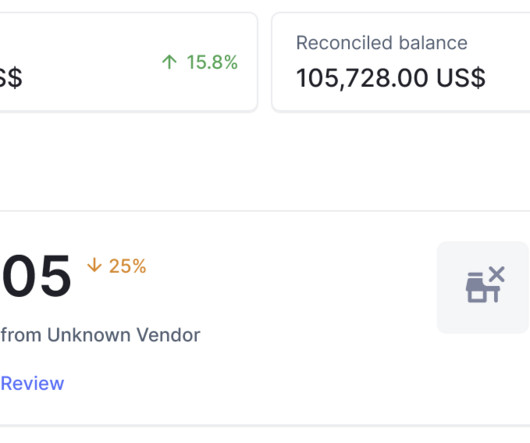

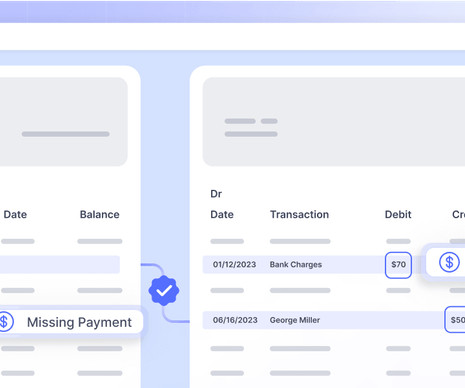

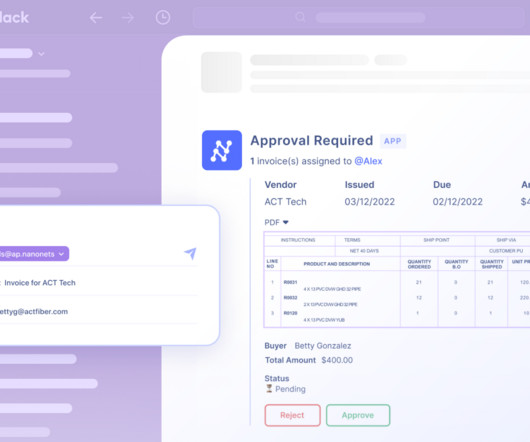

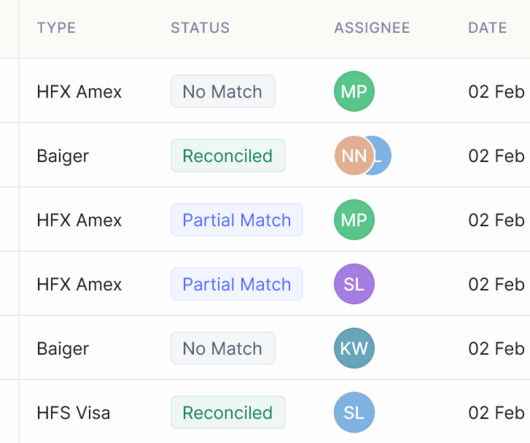

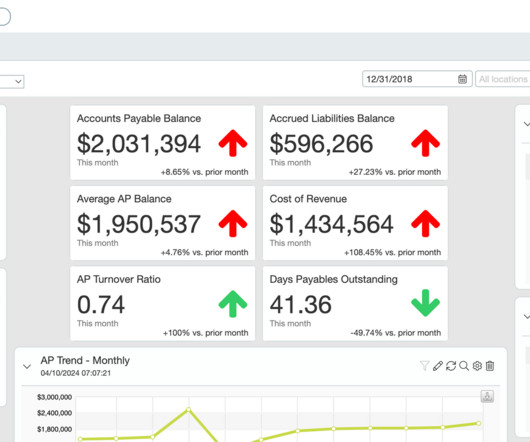

As businesses adapt to the accelerating pace of technological change and new e-invoicing mandates, one aspect of financial management stands out – accounts payable (AP) automation. Duplicate and fraudulent invoice detection : AI engines can identify potential duplicate invoices or invoices with unusual amounts and flag them for review.

Let's personalize your content