The Evolution of Insurtech and its Impact on Traditional Insurance Models

Fintech Review

JUNE 12, 2024

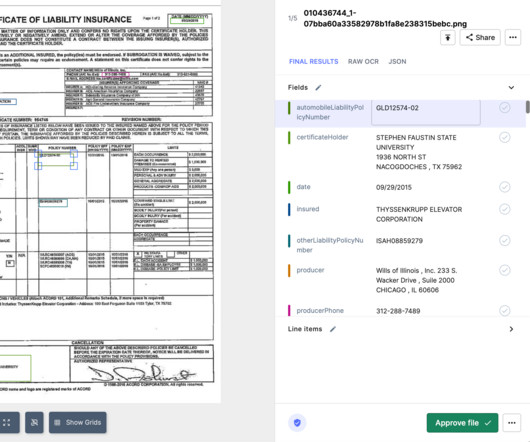

We explore the innovations in personalised insurance products, the role of IoT devices in data collection and risk assessment, and the challenges faced by established insurance companies integrating new technologies. Enhanced Risk Assessment IoT data provides insurers with a more accurate understanding of risk profiles.

Let's personalize your content