Home Credit China Cuts Risk by 25 Percent on Thin File Loans

FICO

MARCH 25, 2020

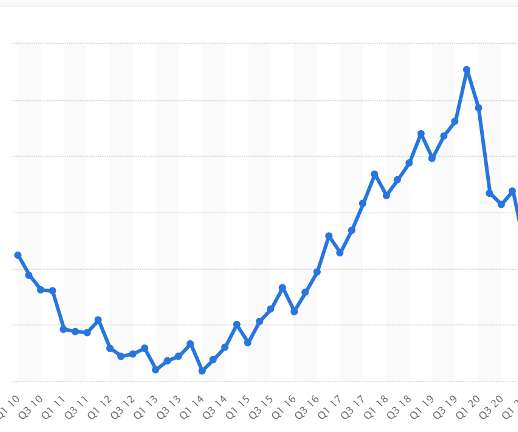

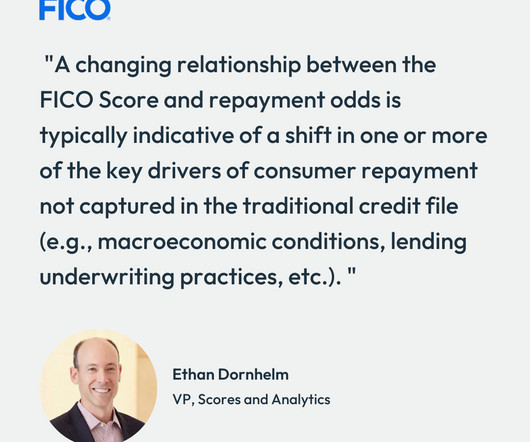

Home Credit , a global non-bank consumer lender, has successfully reduced its credit risk while maintaining loan volumes and keeping approval rates steady by incorporating the FICO® Score X Data to optimize its loan process in China. They are one of our most sophisticated clients in terms of advanced analytics.”. by FICO.

Let's personalize your content