PCI DSS Requirement 10 – Changes from v3.2.1 to v4.0 Explained

VISTA InfoSec

MARCH 6, 2024

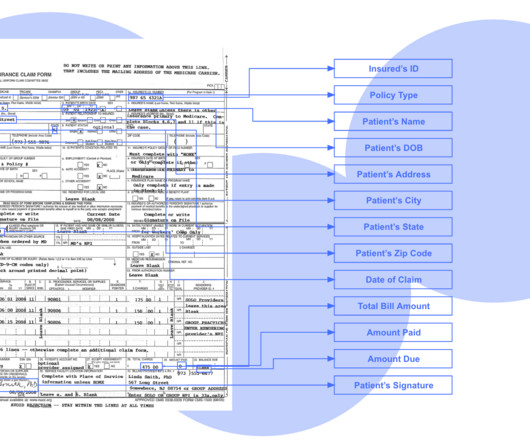

assessment, understanding these changes to Requirement 10 will help you strategize your implementation approach. Minor adjustments to testing scope. Other Logs Review "periodically" based on the company's risk assessment Periodic review is still required but now explicitly mentioned in Requirement 10.4.2 assessment.

Let's personalize your content