Recurring Billing: Definition, How it Works, and Best Practices

Stax

MARCH 6, 2024

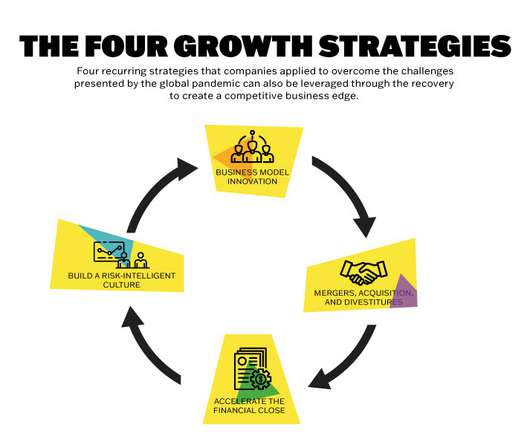

By the end of this guide, you’ll have `a clear overview of its operational framework, strategic benefits, best practices, and advanced strategies to maximize this powerful, rapidly rising payment tool. TL;DR Recurring billing is a powerful solution to streamline processes and enhance revenue generation and customer engagement.

Let's personalize your content