How To Do Accounts Receivable Reconciliation

Nanonets

MAY 21, 2024

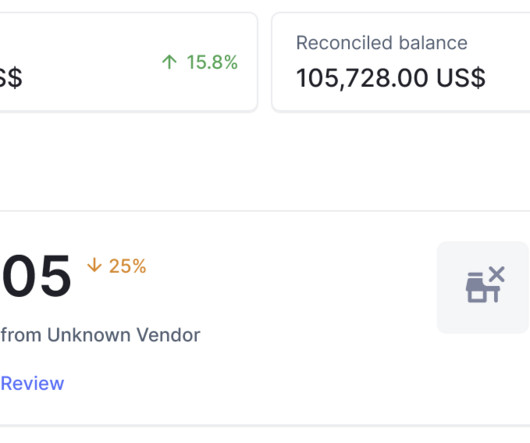

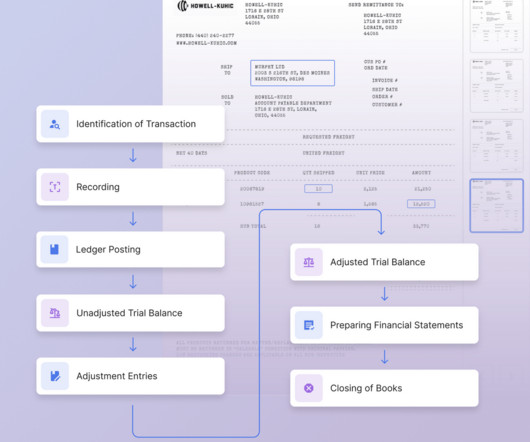

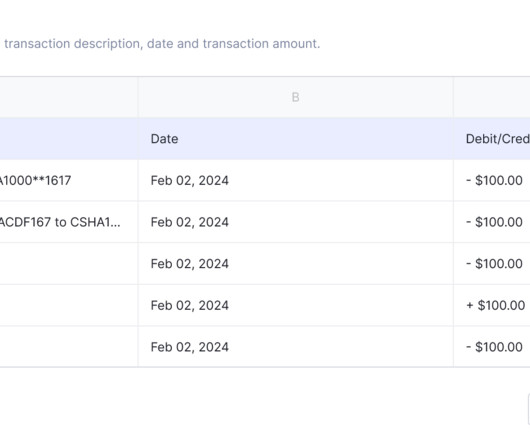

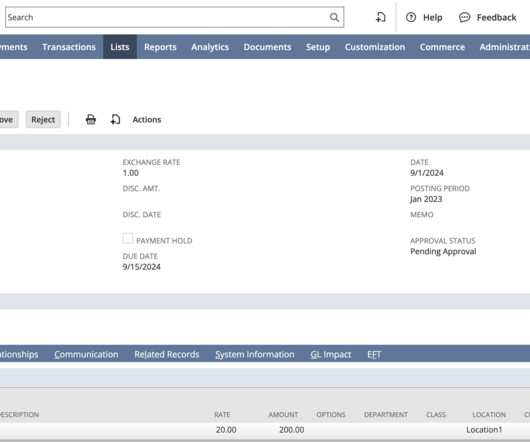

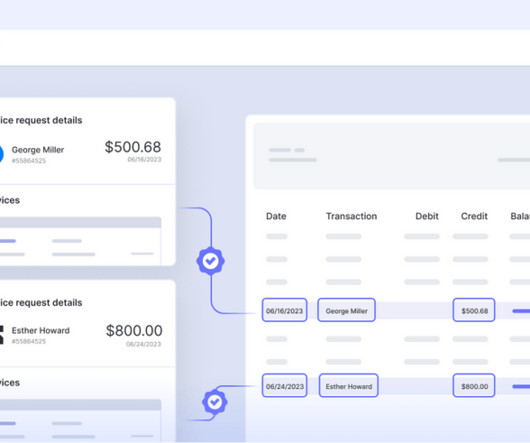

Review Sales Transactions: Compare the sales transactions recorded in the accounts receivable ledger with the corresponding sales invoices or sales orders. Ensure that each payment is correctly applied to the corresponding customer account and invoice. Adjust Ledger: Correct errors by updating entries and balances.

Let's personalize your content